ABM Segmentation: How to Divide & Conquer Your Target Accounts

What's inside

Have you ever walked into a store that felt like it was made just for you?

The products you needed were set up front and center, the prices were exactly what you wanted to spend, and the attention from the store employees was just enough, without being too much.

That’s the kind of experience that you want to give your customers.

When developing an ABM strategy, identifying key segments of your audience can help you build a buying journey that’s personalized for them.

Sounds simple, right?

The problem is, this can go wrong in a number of ways.

You could spend months building beautiful new segments, only to find that Sales is disqualifying these new leads, or they’re not converting at the rate you were expecting.

Segments can be a powerful tool for ABM—or a huge time-suck. And how you build them out will determine which category your segments fall into.

You know segmentation can boost LTV and shorten sales cycles—but here’s why it’s not working

Segmentation is all about dividing your target accounts into distinct groups based on common characteristics like industry, role, or region.

The point? To tailor your messaging.

Imagine you sell project management software to both marketing and product design teams. How you speak to each of these groups—and how you sell your product to them—is very different.

Marketing teams will probably be more interested in content about creative collaboration and campaign management, while product design teams might want to learn more about agile project management and workflow efficiency.

When you segment to these different audiences, it allows you to:

- Tailor your messaging and content for each segment (e.g., create personalized ads for a segment that uses a specific tool or that’s in a specific region).

- Align sales outreach with specific needs and pain points of this segment.

The result in the long run is faster sales cycles and higher-quality deals.

Unfortunately, a lot of teams hit serious roadblocks with their segmentation strategy.

One common issue is getting the balance wrong.

If your segments are too narrow, you risk missing out on potential opportunities or overwhelming your team with dozens of micro-segments that are only slightly different from each other. Too broad, and your messaging becomes diluted.

Another big hurdle is misalignment between marketing and sales on which accounts matter.

Marketing might be focused on brand awareness or firmographic fit while sales cares more about immediate revenue potential.

When these teams don’t share an ICP and clear segmentation logic, those divisions will only become worse as time goes on (and fixing them later is a headache you don’t need).

Not having clear, accurate data is another challenge many ABM teams face. Data that is duplicated, outdated, or isn’t integrated can wreak havoc on your segmentation efforts.

Xenia Busheva, Co-Founder and CMO at Pronounce AI, explains, “From my experience, most teams have way more data than they actually know what to do with—it’s scattered across CRMs, marketing automation tools, and sales outreach platforms. Too often, we end up with “analysis paralysis,” sifting through so many data points that it’s impossible to decide which are truly helpful for building meaningful segments.”

Is building segmentation into your ABM strategy hard?

Yes, but it’s also worth the effort.

Let’s break down the four main steps you’ll need to take to set up the right foundation for segmentation:

- Decide whether your target market needs segmentation.

- Choose a segmentation strategy that sits in the middle of too wide and too narrow.

- Consolidate and validate your data.

- Align with sales on the segments you want to target and prioritize.

1. Decide whether your target market needs segmentation

Before diving headfirst into the deep end of segmentation, it’s important to take a step back and ask yourself this simple question:

Do I really need segmentation?

If you’re already focusing on a very narrow audience with similar needs, breaking that down into even smaller groups could just add unnecessary complexity—a burden on your team that won’t pay off in the long run.

Here are some questions to ask yourself when deciding if segmentation is right for your ABM strategy:

- How diverse is my market? Are your target accounts similar in size, industry, and needs? Can you easily identify different groups within your target accounts, maybe ones that work with a specific competitor, are based in different regions, or have different challenges or pain points to solve with your product? If so, segmentation can help you pinpoint those nuances.

- Is the sales team divided by segments? Your sales organization is on the front lines of dealing with customers. If they’re already split by industry, region, or buyer role, it’s a strong sign that segmentation is working—and necessary—for more precise targeting.

- What resources does my team have access to? Segmentation only works when your team has the capacity to manage multiple account clusters. Do you have enough team members to dedicate to different segments?

Here’s an example.

Let’s say you sell scheduling software for teams launching astronauts into space.

Your total viable market may consist of just a few accounts, and any variations will be minor. You’re already so focused that adding more segments won’t help your team sell more—it’ll just weigh them down.

On the other hand, let’s say your scheduling solution applies to both space travel and plane travel. Now, you’ll probably benefit from creating distinct segments for each, making sure each group receives a message that resonates with their unique needs.

2. Choose a segmentation strategy that sits in the middle of too wide and too narrow

Some restaurants hand out special menus for people who are gluten intolerant. But can you imagine trying to create a menu that caters to every intolerance or preference?

You’d end up with menus that are gluten-free, dairy-free, vegan, vegetarian, pescatarian, low sugar, low salt, Keto, spicy, non-spicy, peanut-free, and any combination thereof.

That would quickly turn into a nightmare, not only for the wait and kitchen staff, but also for the customers.

The problem is that segmentation can go the same way—it’s far too easy to complicate things to a point where they’re completely out of control.

As Xenia Busheva puts it, “When I first started working in ABM, I tried segmenting everything under the sun. We ended up with so many micro-segments that each required its own campaign—that quickly became unmanageable.”

Her advice?

Only subdivide when it actually changes your messaging or approach.

Here’s how to choose the right segmentation strategy.

Decide on the right depth of segmentation criteria

If this is your first time building segments, or if you’re overhauling a segmentation system that isn’t working, just close your eyes for a second and repeat this mantra:

Keep it simple.

How deep you go with segmentation criteria will depend mainly on the answers to these two questions:

- Do I have something specific to say to this group of people?

- Do I have the resources to personalize my ABM strategy to these groups?

For larger segments, you’ll probably look at these major characteristics:

- Industry

- Product type

- Market category

- Location or language

Look at your existing customer base to see which characteristics make sense to segment into different groups.

For example, if you sell CRM software for startups, you may have a variety of industries that you sell to, such as healthcare tech or consulting services.

Or, your main markets may be partially in the US and partially in Germany.

Maybe your software is divided into different products, and there are key segments of your audience that are interested in different products.

These are all valid segments that would benefit from specific messaging.

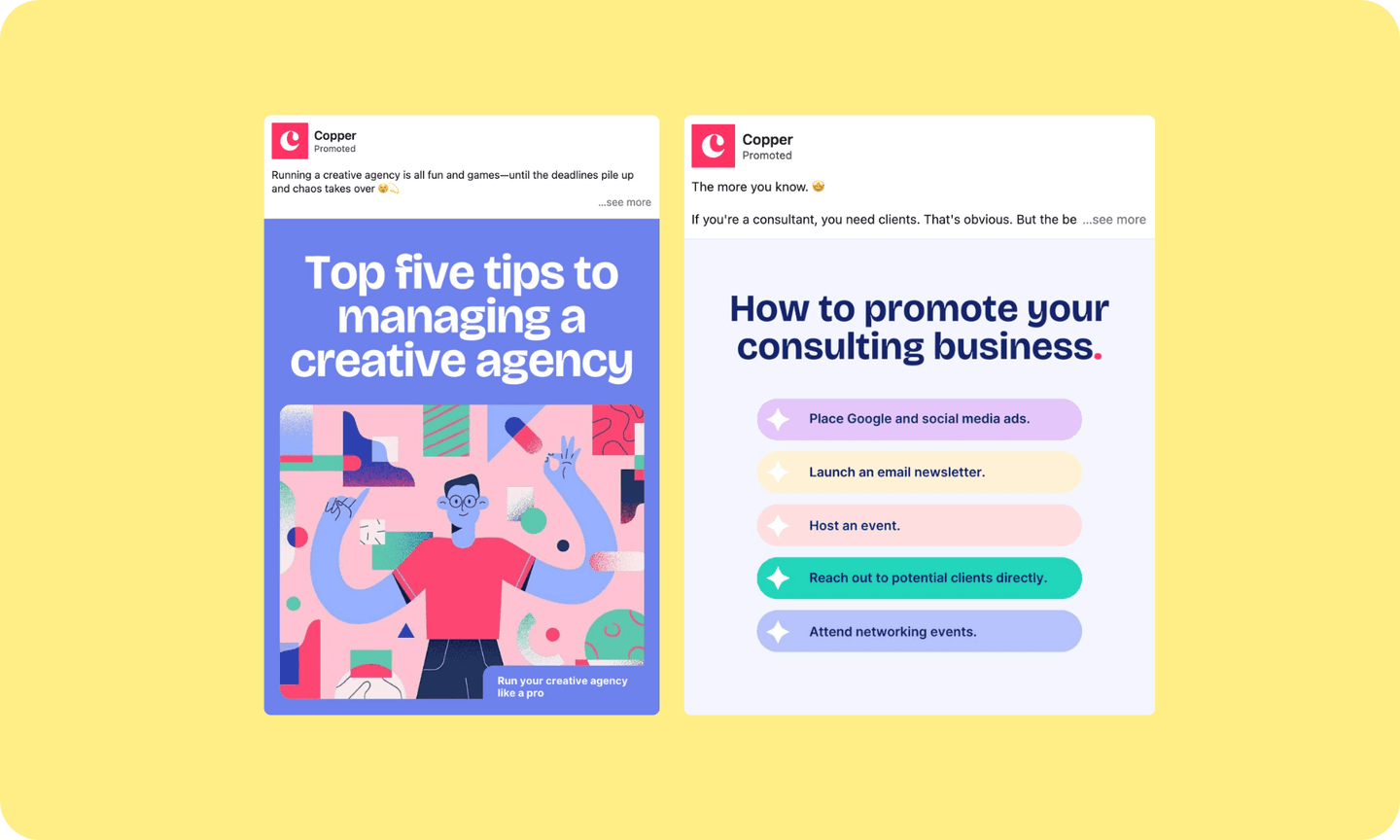

Here’s a real-world example from Copper: they sell to different audiences, including creative agencies and consultants. So, they created targeted ads with content that appeals to those different audiences.

But now, maybe you want to go deeper and build even smaller groups within your audience that you can target with more precise messaging.

Here are some characteristics you might look at if you want to create micro-segments:

- Niche industry focus: Using our example above, instead of just consultants, you might segment out marketing consultants who work with SaaS companies.

- Specific pain points: For example, segment out consultants who are having trouble keeping track of their existing clients vs. consultants who are struggling to find new clients.

- Buying process stage: Following the same example, this could include consultants who are aware they need a CRM solution, or consultants who are trialing different CRM tools.

Leverage Cohorts for persona-based micro-segments

Often, when people talk about segmentation in ABM, they refer to accounts, but another way to refine your audience is to segment at the persona level.

While account-level segmentation addresses the “who” at a company level, persona-level segmentation pinpoints “who” within each company.

This is the approach we take at Influ2.

We have a very specific ICP that we go after and once we’ve identified the type of account, we identify the personas. To do this, you can listen to recorded sales phone calls and see whose needs you’re meeting with your product.

We target a few different personas, but who you target depends on whether you have something different to share with them, and what content they’ll be interested in.

So we may target C-level execs who may be interested in new technology, marketing leadership who would be part of the buying process, marketing ops who handle the tech, and sales and SDR positions because they’re consumers of our product and are important to get buy-in from.

So, how do you build persona-based micro-segments? The right tool can help.

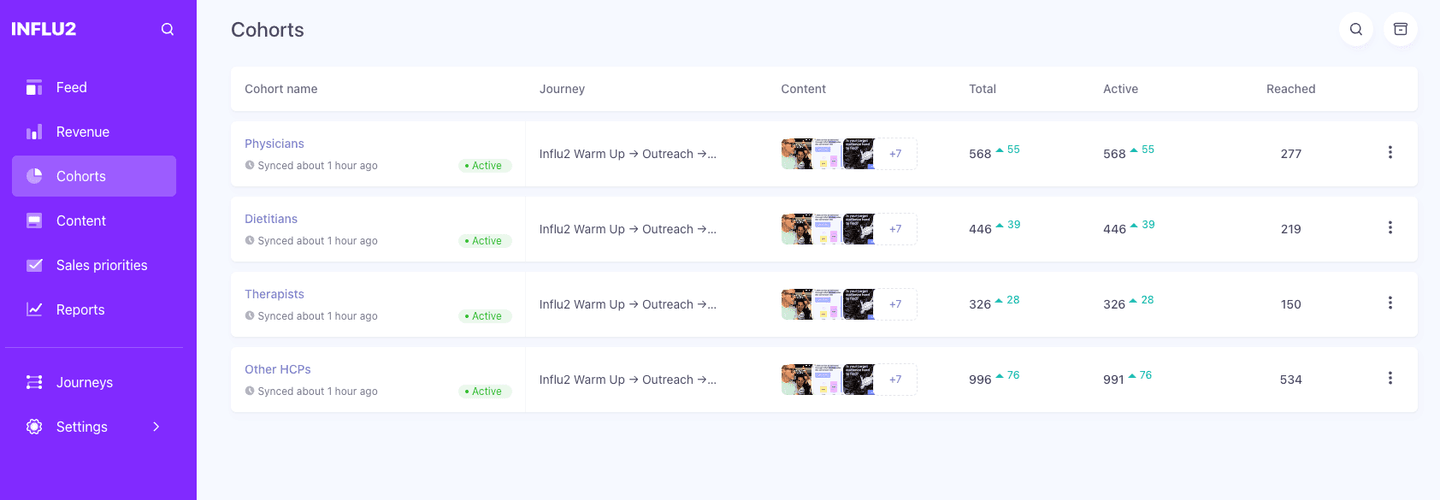

With Cohorts in Influ2, you can create ad campaigns that target specific contacts in your target accounts that Sales is actively pursuing.

We pull this data directly from your CRM, meaning all you have to do is choose which data points to segment by—such as role, location, or other contact-specific information—and Influ2 will target those people specifically with your ads.

Once this is set up, you’ll have access to a dashboard, showing you how many people are in each cohort at the moment, how many people you’ve reached, and which content is going out to them.

You can also create specific ad journeys for each cohort, so creatives are updated based on their stage in the buying process.

3. Consolidate and validate your data

At this point, you’ve probably identified a few potential segments that you could target within your ABM strategy. But the journey doesn’t stop there.

Now, it’s time to use real data to validate the segments you’ve identified and choose how to target them.

Georgi Todorov, Founder of Create and Grow, shared his experience, “At first, we had trouble with 15 or more micro-segments that made it hard to personalize. We boiled down our tech client's pipeline data into 4 high-impact segments based on buying signals and deal velocity. In Q4, this focused approach led to 167% more qualified opportunities.”

So, how do you use data to build stronger, more impactful segments?

Clean up your existing data

The data you’ve gathered based on real interactions with your customer base is invaluable.

But it’s only useful if your data is clean.

Xenia Busheva recalls, “We once discovered that a major strategic account existed in our CRM under three different names. Not only did this triple our marketing outreach efforts, but it also caused sales reps to step on each other’s toes because they were reaching out to the same company.”

If you’re not sure you can trust the data at hand, it’s time to take action:

- Run a thorough deduplication process: Many CRMs offer this as a built-in feature, but you can also use third-party integrations like ZoomInfo or Clearbit for an extra layer of cleaning.

- Set up regular data audits: Set a schedule (monthly, quarterly, etc.) to audit the data stored in your CRM or BI tool. Look for inconsistencies, outdated records, or duplicate entries.

- Use automated data validation rules and alerts: Most CRMs and BI tools allow you to automatically flag records that don’t meet your quality standards. This could include missing data, outdated information, or unexpected changes in customer profiles. Automated alerts ensure issues are addressed quickly, keeping your data reliable.

Note: This is an exercise best performed alongside your sales and CS teams. When everyone’s data is clean and aligned, it means you can make better decisions together about which segments to target and prioritize.

Analyze your proprietary data to find potential segments

Now that you have a dataset you can trust, what do you do with it?

Analysis paralysis is real, and your data is only useful if you’re looking at what matters.

So, what really matters when it comes to segmentation?

Ultimately, this will depend on what matters most to your overall company goals.

But to build segments that support revenue growth, it’s important to analyze existing accounts in a way that answers the question: “Who is bringing consistent, long-term revenue to the company?”

Here are some data points you can analyze:

- Number of existing customers in a potential segment

- Existing average annual contract value (ACV)

- Customer lifetime value (LTV)

- Win rate

- Average sales cycle length

- Existing pipeline

- Revenue potential for net-new customer acquisition

- Revenue potential for expansion of existing customers

As you analyze the data, give each of these criteria a score, and do weighted segment scoring to see which industries to go after.

For example, let’s say you identified the fintech and health-tech industries as potential segments within your customer base.

By analyzing the data, you can see that your average win rate for fintech is higher than health-tech.

But the customer lifetime value of your health-tech customer is much higher, and the revenue potential for new customers and expansion is also higher.

By weighing how much each of these data points matter to your company, you’ll see clear winners and losers in your potential segments, and know which targeted groups can really improve overall growth.

Want to make it even simpler? Optimize for lifetime value.

In fact, 41% of marketers cited LTV as being the most important piece of data to capture and manage for ABM.

When you choose your segments based on LTV, you’ll find it much easier to get buy-in from sales, success, and marketing.

New leads that are optimized around LTV bring better results to the company overall, which means sales will be excited to close them, and CS will be motivated to onboard them in the best way possible.

Validate your data with third-party tools that integrate to a single source of truth

Your proprietary data is valuable, but when you validate and enrich that data using third-party tools, you’ll have an even better chance of selecting high-quality segments.

Why is it so important to go beyond the data you’ve gathered on existing customers?

According to Lyndsay Vella Handlos, Founder and CMO at Vella Handlos Consulting, one common mistake is leveraging outdated historical knowledge over current data.

She says, “I usually see this with long-term team members who don’t leverage data for decision-making. As a result, segments fail to align with the target audience and result in a missed opportunity.”

Want to avoid this trap? Here’s what you can do to:

- Work with multiple data sources and enrichment tools: Third-party ABM tools like Apollo and LinkedIn Sales Nav, and others can help you verify and enrich the data that you’ve already collected.

- Plan for some manual research: Especially when dealing with high-value enterprise accounts, you may need to do manual research into the company to find accurate, meaningful data about the tools they use, the people in their buying committees, and more.

- Centralize your data: Link all data sources to one singular “source of truth.” Typically, this will be your CRM or BI tool, something that is used across teams to analyze data. When all data is linked there, it’s easier to maintain consistency across teams as you target specific segments.

When you combine the data from your customer base with third-party data—everything from firmographic, demographic, intent, and engagement—you’ll have a dataset that tells you everything you need to know about your potential segments.

Using the weighted scoring we mentioned above, this data can help narrow down your potential segments to the ones that matter most to overall company goals.

4. Stay aligned with sales on the how you’ll prioritize your segments

Working with sales from day one is the best way to get fully aligned on segmentation. But that collaboration doesn’t stop once your segments are created.

Your sales team has the most experience talking with new leads and can tell you a lot about what works and what doesn’t.

Aligning with them on which segments get the most attention and how that attention is delivered will help you build the foundation for tighter messaging, fewer wasted efforts, and better results overall.

Collaborate continuously on segment definitions

The best way to make sure your segments are really working? Lean into the expertise that your sales team already has under their belt.

“One of the most helpful things I did was invite sales into the segmentation process right from the beginning,” says Xenia Busheva. “We hold a quarterly session to talk about which accounts fit Tier 1 or Tier 2. Marketing comes in with data-based recommendations, but sales has the final say if they know something we don’t—like a new competitor in the account or a sudden leadership change.”

The expertise of salespeople in the field is worth more than any data you might collect.

For example, you can see data about customers in a certain industry—how long it takes on average to close deals, which tools they use, their headcount, and more.

But the salespeople working this industry hear these people talk about the challenges they face, their struggles, their goals, and how your product helps them on an individual level.

Those are insights your dashboards and BI tools can’t tell you.

Build prioritization criteria and allocate the right resources across teams

Choosing your segments is one thing—now, alongside your sales team, it’s time to determine how you’ll prioritize those segments.

First, know the resources you have at hand. We talked about this above, but it’s important enough to mention again: segmentation only works when you have the resources to support those segments.

Next, determine how many resources you can dedicate to each segment.

To simplify things, many ABM teams focus on tiers for segments. Usually, these tiers are divided into three different levels:

- Tier 1 (high touch): These are your highest-value accounts, top-dollar deals that require personalized, one-on-one engagement. There will only ever be a handful of key accounts in this tier, and each will get its own bespoke campaigns with things like custom demos, executive roundtables, or tailored whitepapers or proposals.

- Tier 2 (segmented): This tier includes accounts that are grouped together by common characteristics, such as industry, shared challenges, or specific tech stacks.

- Tier 3 (broad/programmatic): These are lower-value accounts that receive automated, general ABM strategies without heavy customization. You might set up programmatic ads or email drip campaigns that are less personalized, but still speak to common industry challenges.

Remember, the collaboration between marketing, sales, and success is ongoing.

Aside from quarterly meetings between marketing and sales, Xenia also recommends using a live dashboard that shows how each segment is performing—who’s engaging, which deals are open, and so on.

Seeing this information side by side helps both teams trust each other’s priorities and how they’re spending their time.

Divide and conquer your segments

Congratulations! You’ve made it through the four core steps of building a strong ABM segmentation strategy. Now, it’s time to put it all into practice.

Segmentation isn’t a “set it and forget it” process—it’s an ongoing, evolving strategy that benefits from regular evaluation and fine-tuning.

In other words, you’ll want to schedule periodic check-ins with sales to see how each segment is performing, which accounts are converting, and where adjustments might be needed.

Want to get the most out of your segments?

Influ2 can help you reach individual decision-makers at your target accounts with contact-level ads. By measuring individual engagement, you can continue to refine your segments, making it easier to divide and conquer your audience without overwhelming your team.

Keep testing, stay flexible, and watch as your segments turn into a powerful engine for sustainable growth.