What is Intent Data & How to Uncover It

The pitch behind intent data really is compelling.

Knowing who is in the market and what they care about before you even speak to them?

It's every sales rep’s dream.

That dream has led to many teams seeing intent data as a silver bullet. That is, until they get data from a third-party provider and realize that it's trickier to put into practice than it seems.

Even experienced GTM leaders struggle to turn that dream into reality.

Here’s how to practically use intent data to design more effective Sales and Marketing programs.

What is intent data?

Intent data is the information sourced from an intent signal, which is the action a prospect takes that indicates they might have some interest in buying.

Let me explain with an example.

If someone clicks on your ad, that’s an intent signal. The ad they clicked, the landing page they saw, and what other pages they visited are all intent data.

Basically, intent signals create intent data, which is what marketers and salespeople can actually use to personalize the buying journey and make their marketing and sales outreach more relevant and effective.

But not all intent data is equal.

Account-level intent data tells you that someone within a company may be interested in a topic related to your product.

An ABM tool might tell you that Asana employees are browsing your product category on G2, but it won’t tell you who is doing that research.

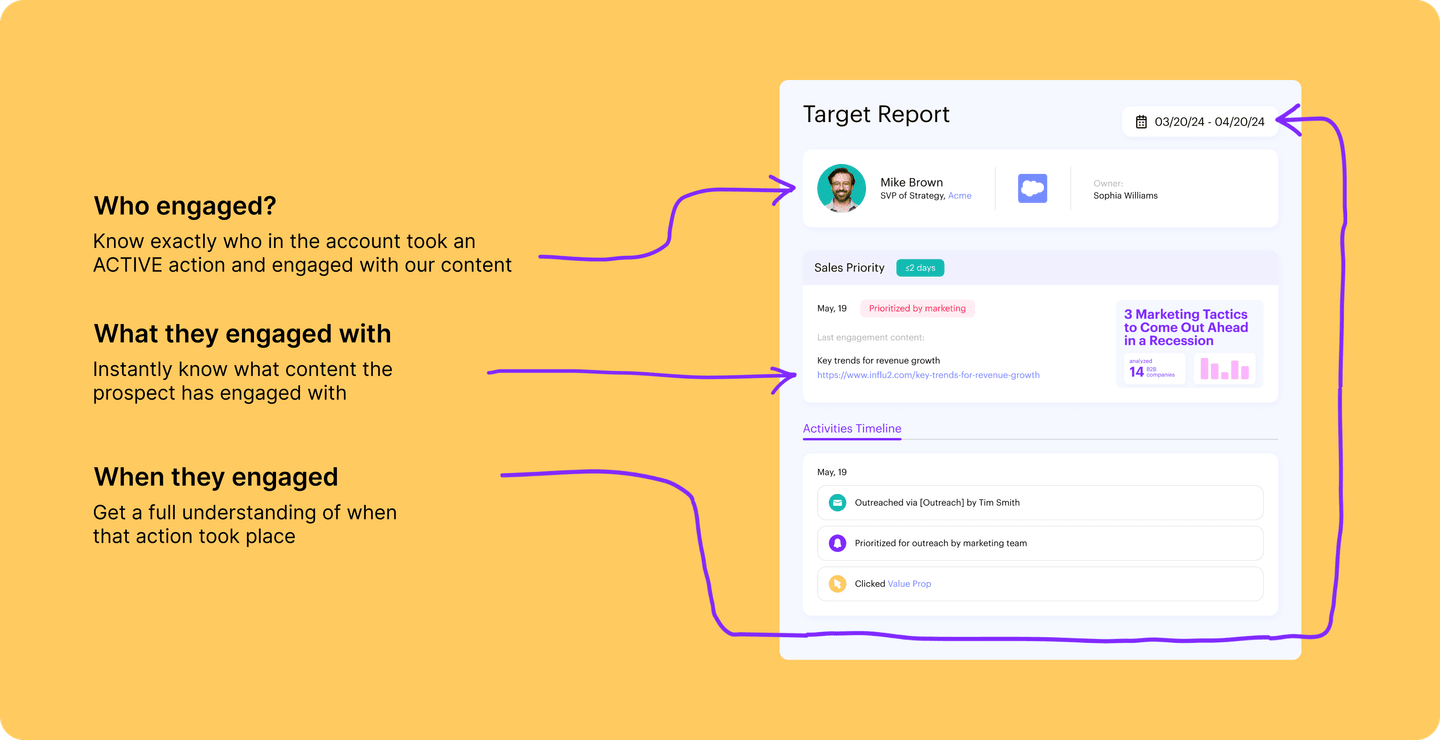

Contact-level intent data, on the other hand, can tell you which individual decision-makers, champions, and influences within an account are showing interest in which topics. It’s much more specific and targeted.

Both are valuable, but sourcing contact-level intent data, where possible, will give you more actionable information.

Where intent data comes from

There are three main places from which to source intent data.

Your own assets

Your website, ad campaigns, CRM, and even your product are all sources of intent data. You can collect and analyze data on:

- How visitors behave on and interact with your website

- User interaction with your product (such as commonly used features)

- Content consumption habits (email opens, ebook downloads)

- How viewers engage with your ad programs

Review sites

Sites like G2, Capterra, and GetApp are prime sources of intent data. They can tell you:

- What features and functions are considered priorities for your target market

- Which potential accounts are actively comparing competitors

- Who is unhappy with their current provider

Data vendors

Third-party intent data vendors provide information on user activity across the web, such as topics that accounts are researching, content consumption, and ad engagement habits.

How to use intent data to fuel more effective Sales and Marketing programs

For most Sales teams, access to data isn’t the problem. It’s knowing what to do with it.

Nick Ruggieri, Head of Sales at Koala, has an interesting take on this.

He argues that collecting intent data is like owning a fitness tracker.

You can monitor metrics like HRV (heart rate variability), respiratory rate, and Strain score, but simply knowing those stats doesn’t necessarily make you any healthier.

What’s important is knowing how to act on that information, like deciding to take a rest day when you see your sleep, recovery, and HRV are all trending downward.

Here’s how you can put all of that intent data you’ve been collecting into action.

Go head-to-head with your main competitors

Say you collect third-party intent data on prospect search behavior.

Not all of that information is going to be actionable, but what that data can tell you is which competitors your prospects most commonly search for in the solution-aware part of their buying journey.

You can aggregate that intent data, uncover the top five competitors that buyers have in their consideration sets, and launch campaigns to specifically target those competitors, such as:

- Building “Your product vs [competitor product]” landing pages to position your brand as a stronger alternative

- Targeting competitor-branded keywords in Google Ads, directing clicks through to those comparison pages

- Making battlecards for your salespeople to align competitive product messaging

- Mentioning those competitors in your outreach email sequences to target objections head-on

Re-engage prospects who ghosted you

Not every close-lost deal is lost forever.

You can use intent data from third-party providers, review sites, and engagement with your ad programs to uncover when a previously unresponsive prospect has started researching your category again.

Say someone ghosted a rep six months ago, and Sales moved them to closed-lost. Now, they’ve started engaging with some competitor content on LinkedIn.

It's a good signal, but there’s not enough data to revive the lead and run the whole Sales playbook. Instead, marketing puts them into a general nurture campaign, running some value prop ads.

The prospect clicks on one of these ads, giving you first-party intent data. You combine that with some additional third-party intel, which tells you that they’re checking out competitor comparisons and looking at pricing pages.

Now, Sales can re-engage and run a LinkedIn InMail and email outreach sequence, with messaging related to the ad content they engaged with. Marketing can support with some High-Impact ads re-introducing the SDR, helping them cut through.

Produce more of the content that connects

Every time someone signs up for one of your webinars, you’re collecting intent data.

That data tells you something about that particular buyer (that they are interested in a given topic), but it also gives you insight into your market more broadly: the more sign-ups a webinar gets, the more intriguing that topic is to your target audience.

Use this intent data to create curated content about the most popular topics, then use that to inform your outreach and new marketing campaigns.

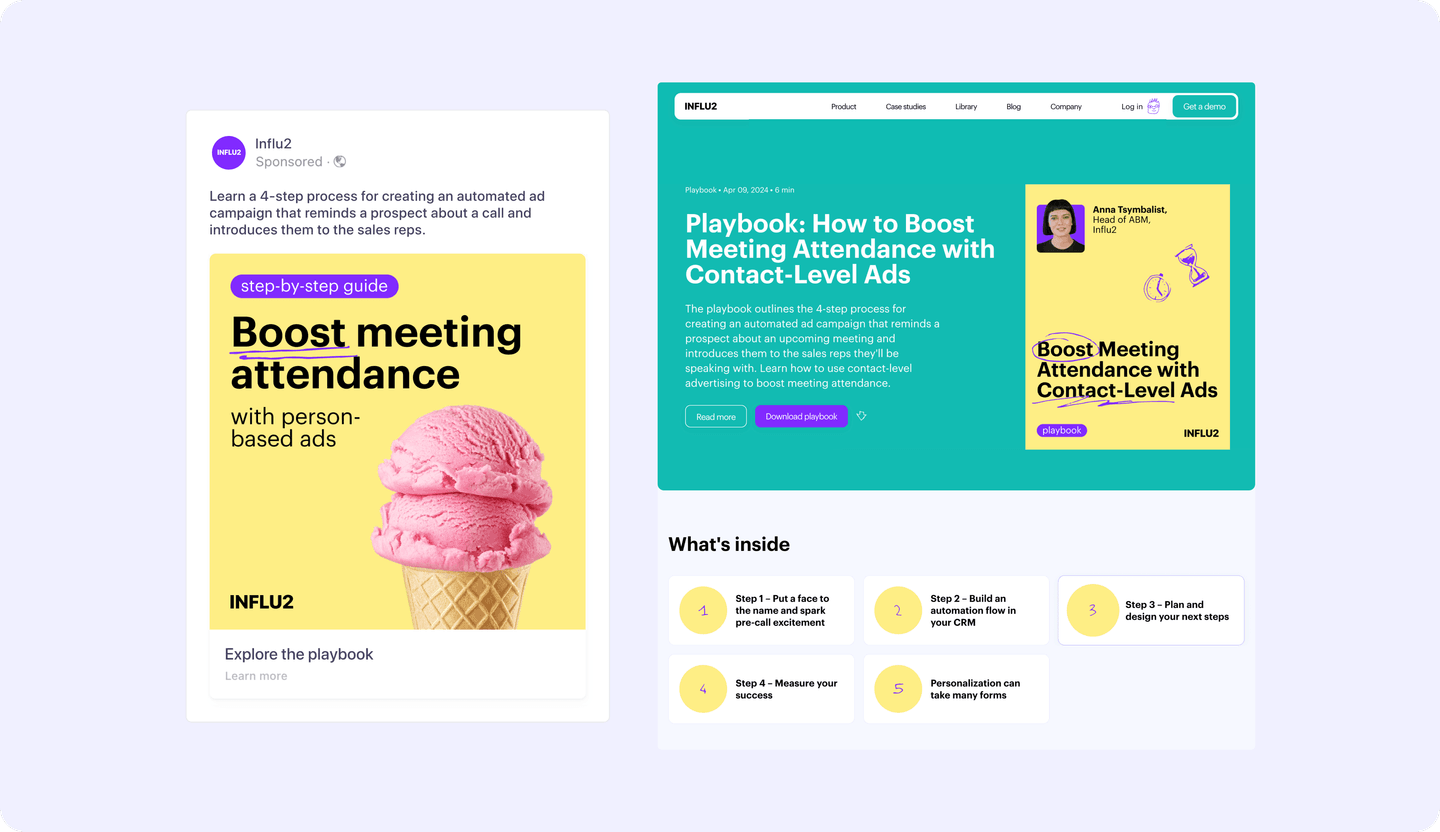

Let’s say your most popular webinar is on how to boost meeting attendance.

You could experiment with attendance-related messaging in your outreach sequences, with Marketing providing air cover via ads that promote a playbook on the topic.

Design personalized account expansion programs

Intent data isn’t just for closing new customers; it’s useful for expanding existing accounts also.

For instance, if you’re about to run a cross-sell campaign for a new add-on product you’ve just launched, you can analyze product usage data to understand which of your current customers have a solid use case for the new feature.

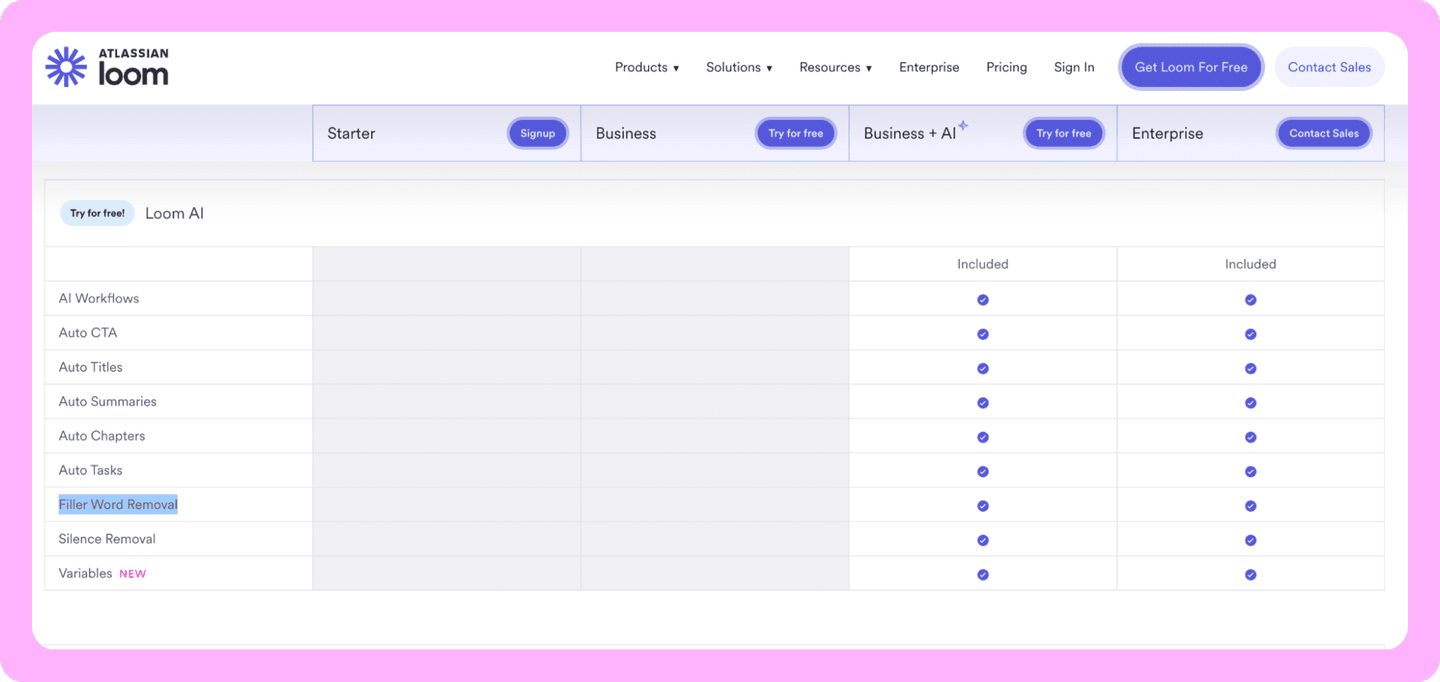

Take Loom. Their AI feature includes automatic filler word and silence removal and is only available on the Business + AI and Enterprise plans.

Loom’s product data can tell them which customers are currently using the product’s manual editing tools—a good sign that they might have a use case for AI editing functionality.

The revenue team can then segment and target those accounts, with Sales and Success teaming up on personalized outreach to upsell Starter and Business-tier accounts.

Tie your product into an existing tech stack

Technographic data—intel on what tools target accounts have in their tech stack—can be used to identify a segment of the market you can target with a particular angle, one that’s focused on how your product builds on one they’re already using.

Qualified, for example, is built specifically to sit on top of Salesforce and leverage its data to drive AI sales conversations. That means every enterprise Salesforce user is a potential Qualified customer.

The Sales team at Qualified could research technographic intent data to uncover a segment of the market that recently implemented Salesforce and target them with:

- A whitepaper that explains how the two tools build on each others’ capabilities

- A case study that demonstrates how a real-life customer uses Qualified and Salesforce to close new revenue

Win over unsatisfied customers

Another way to go head-to-head with your biggest competitors is to monitor how their customers speak about their product on review sites like G2.

You can filter for every person who left a 3-star or lower review for a competitor and then use ChatGPT to semantically analyze the review they left.

What you’re looking for here is customers who complain about something that is a limitation for that competitor, but a strength for you.

Maybe your biggest competitor offers great value price-wise, but underdelivers on service. Your offering is more expensive, but the customer gets a dedicated, hands-on Customer Success Manager.

You can use this intent data to identify users that mention CS or service in their negative review, then add them to an ad program that speaks directly to that pain point.

Bring learnings through to future ad campaigns

You can also use intent data to optimize existing campaigns and inform new ones.

If you’re running contact-level ads with Influ2, you can see ad performance by cohort. Then, you can analyze that intent data to understand why those ads are performing well with those cohorts.

For example, you might identify that Sales Managers in FinTech:

- Interact most with ads that highlight AI-powered sales insights, suggesting they’re particularly interested in automation and efficiency.

- Tend to click through on case studies rather than feature-based ads, indicating that social proof and real-world success stories resonate more with them.

- Engage more with ads featuring testimonials from similar-sized companies, suggesting that peer validation is a major trust factor.

In future campaigns targeting that audience, you may want to segment by company size, then lean heavily on case studies from similar-sized companies that speak to how your product drives efficiency.

Intent data is just one puzzle piece

Intent data is never going to be a silver bullet.

But if you know which data points to pay attention to and where to use them, intent data can be a powerful tool in designing more effective Sales and Marketing programs.