Back in 2020, SeriousDecisions published an expose on the sizes of buying committees. They surveyed multiple B2B buyers to discover how many people are usually involved in a final buying decision. 20% of respondents said their buying committees consisted of two people, whereas the overwhelming 80% confirmed that three or more people were involved in the purchase process.

At the same time, Gartner reports that the typical buying group for a complex B2B solution involves six to 10 decision-makers. There’s also other research by Clari that the modern buying groups include at least 7 decision-makers but not more than 19.

In 2023, this stat is hardly surprising. B2B marketers have long learned that their sales cycles are irritatingly long and include at least a zillion touchpoints with different stakeholders. The importance of a multithreaded approach doesn’t raise any doubts. But there’s still a lot of confusion around the exact number of people a business should target to maximize pipeline generation and the role of marketing in it.

Luckily, we have our data to answer these questions.

We've analyzed 42,000 prospects across the databases of 20 software companies to find the best number of buying group members for marketing and sales to engage and maximize pipeline generation.

How does the number of outreached buying group members impact conversions?

More specifically, we wanted to analyze the correlations between the sizes of buying groups, how they convert to opportunities, and the influence of advertising on this entire process. There are three key takeaways from the study:

- Identifying key stakeholders and brand champions is crucial for understanding your buying groups. By including more people in their outreach, sales can improve conversions by up to 7.5x.

- Multichannel targeting is essential: the difference in conversions between ad-influenced and cold outreach can reach 6%, depending on the size of a buying group.

- Conversion rates grow exponentially with the number of outreached prospects. In bigger buying groups, sales outreach can increase conversions by 3.4 — 4.4x if sales talk to 11+ people instead of just one person.

Now, let’s look closer at these numbers.

Reaching out to 11+ people increases conversions by 7.5x

Before anything else, we wanted to look at the correlation between the number of outreached users from a buying group and their conversion rates? Mind you, those are not representative of buying groups’ sizes (not yet) - just the number of people in sales outreach across buying groups of all sizes.

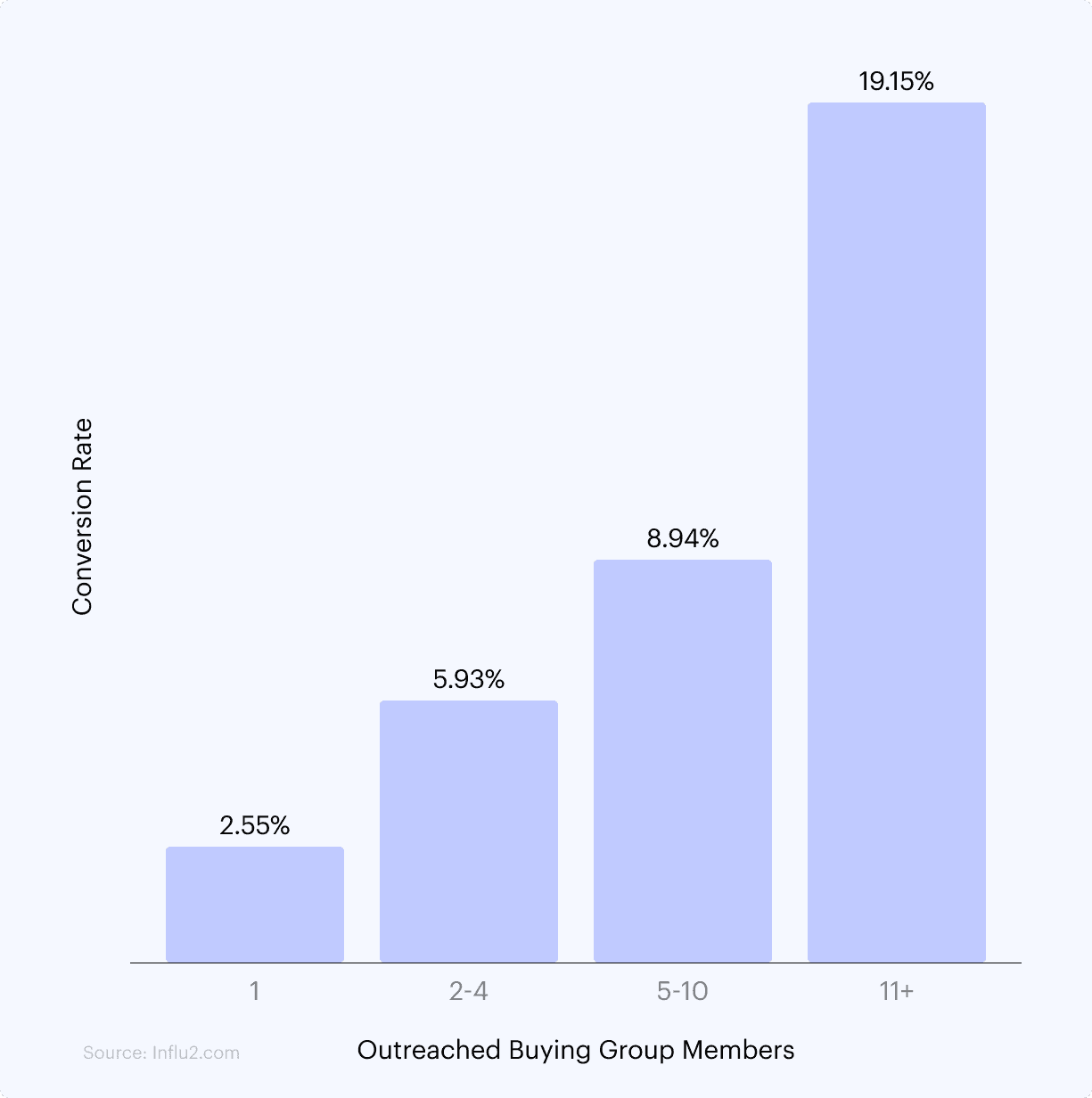

The numbers in our database immediately confirmed that talking to numerous people from the same account leads to more opportunities. It's common sense. Sales need to reach as many people within prospect accounts as possible to maximize your chances of getting through to the right people and covering all decision-makers and brand champions. On the Chart 1 below, you can see the following conversion rates:

- When SDRs talk to 2-4 people simultaneously, their conversion rate is more than double compared to talking to just one person: 5.93% versus 2.55%, respectively.

- Maintaining a conversation with 5-10 people from the same account during their buying journey will lead to a conversion rate of 8.94%.

- And the most impressive result of 19.15% conversion rate is possible when sales reach out to 11 people or more.

This means that by expanding sales outreach from 1 to 11 people, you can increase your chances of getting through to the right people and boost conversions by 7.5x.

Chart 1. Conversion rate by the number of outreached users (bucketed)

Reaching out to 11+ people leads to a 3.4-4.4x conversion lift in bigger buying groups

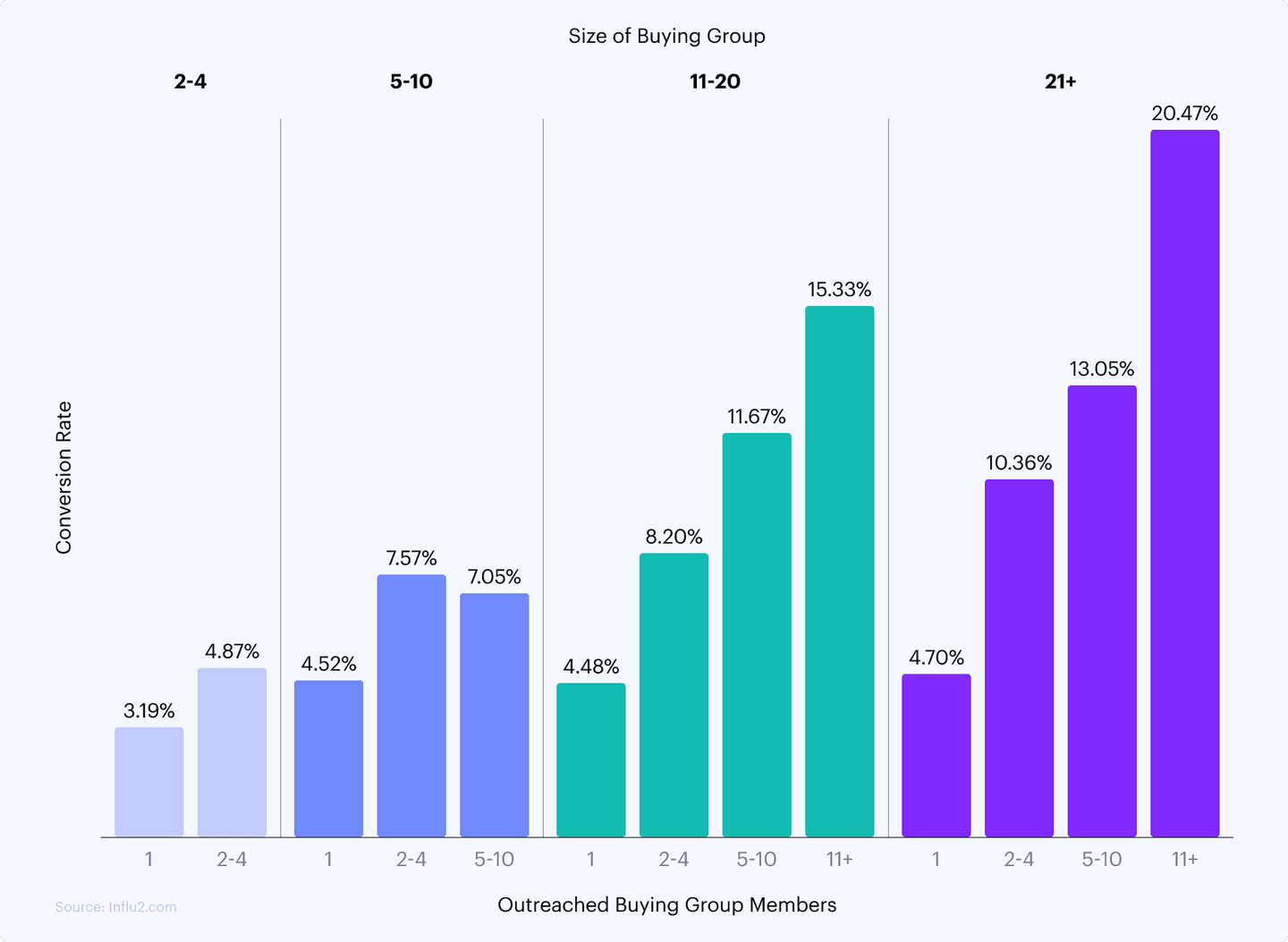

Next, we looked at conversions in buying groups of different sizes in order to understand how the number of outreached people affect conversions in each of them.

In a buying team of 21 or more targets, the maximum conversion of 20.47% is achieved if at least 11 group members are also outreached by sales (see Chart 2). For comparison, reaching out to only one person will lead to a conversion rate of 4.70%.

In other words, companies can increase conversions by 4.4x if they expand their outreach campaigns from 1 person to 11.

In a committee of 11 to 20 stakeholders, you can increase conversions by 3.4x when reaching out to more people. The following conversions can be expected:

- 4.48% when only one person is outreached by sales

- 8.20% when 2-4 people are outreached by sales

- 11.67% when 5-10 people are outreached by sales.

And this applies to buying groups of all sizes.

Chart 2. Conversion rates by the number of outreached users and the size of a targeted buying group

So why do larger buying groups convert better? We can only speculate on the subject. It seems that bigger accounts simply have bigger budgets. Sure, their purchase process is long and excruciating, but they’re also more likely to convert in the end.

For instance, a decision on a purchase of a new martech is made by CMOs, VPs of marketing, and high-level executives. But suppose you also communicate its benefits to other people who might be involved in implementing the tool (like the IT department) or using it (such as marketing management). In that case, it can significantly help your cause. To put it simply, people are more likely to champion a tool that solves their everyday problems and promises faster implementation at a lower cost. And you need to advertise to all of them.

This take is also confirmed by Gartner’s study:

The typical buying group for a complex B2B solution involves six to 10 decision-makers, each armed with four or five pieces of information they’ve gathered independently and must deconflict with the group.

Engaged accounts show the highest conversion rate of 22.88%

So we’ve established that sales should be talking to as many people from a buying group as possible. The next step in our research was to determine the influence of the multichannel approach. More specifically, are prospects more likely to convert if they’re being targeted via multiple channels simultaneously as opposed to cold outreach?

In the chart below, you can see the same numbers of outreached people but split into three groups:

- Cold: prospects with no or insignificant (less than 15 impressions) ad influence

- Influenced: at least one prospect among all outreached people was influenced by advertising (had 15+ impressions)

- Engaged: at least one prospect among all outreached people engaged with ads (e.g., liked, clicked, visited a landing page, etc.)

The impact of advertising on conversions is evident in each group. Committees that were reached after engagement signals show the highest conversion rates. Even more striking is that the probability of conversion increases even if people just see ads on their social media often enough.

In the groups of 2-4 outreached people, only 5.59% convert to opportunity when contacted directly without prior engagement. However, when they are influenced and engaged with an ad, the conversion rates increase to 7.17% and 7.91%, respectively.

The pattern holds for groups of 5-10 people as well. Compared to cold outreach, the conversion rate grows by 4.42% if prospects engage with ads first.

The most significant difference between cold outreach and engagement-fueled outreach is seen in groups of 11 or more people. When they engage with an ad before being contacted, a whopping 22.88% convert into pipeline. This result is followed closely by ad-influenced accounts with 21.52%. In comparison, the conversion rate for cold outreach in this group is 16.85%.

Chart 3. Conversion rate by number of outreached users (bucketed) and context type

To make more sense of these numbers, we just need to put ourselves in the prospects’ shoes. No one likes when sales shove them sudden offers, or marketing bombards them with irrelevant advertising. In fact, Gartner reports that B2B buyers spend only 17% of their total purchase journey in interactions with sales reps, with 44% of millennials preferring no sales rep interaction at all.

But when marketing and sales work together and use each others’ findings in their programs, the entire customer experience just clicks. SDRs enter the conversation once they see actionable engagement signals from ads, and marketers can use sales context to make their campaigns highly personalized.

Considering the average deal involves multiple suppliers, any given sales rep has roughly 5% of a customer’s total purchase time. Sales leaders reluctant to acknowledge customers’ digital-first proclivities will be outpaced by competitors delivering significant value through digital- and omnichannel sales models, engaging customers in digitally rich learning and discovery.