You can't spray and pray your way to enterprise pipeline.

The high-volume lead gen tactics that many B2B companies deploy don’t work at the enterprise level, and traditional account-based approaches often cast too wide a net.

Here’s what we’ve found that does work:

- Targeting specific contacts within buying groups, not entire accounts

- Getting Sales and Marketing on the same page about who you’re going after, how, and when

- Using contact-level ads to connect with individual decision-makers, generate intent signals, and support sales outreach

Below is the playbook that’s helping us generate enterprise pipeline right now.

The role of pipeline generation in enterprise deals

In enterprise sales, pipeline generation covers everything from creating an ICP and identifying target accounts and contacts, through to the moment when the prospect converts to an opportunity in the sales pipeline.

We’re not talking about generating MQLs here (which is a whole problem in and of itself, read why here).

We’re talking about:

- Drawing on historical data to determine who is the best fit for your product and distilling that into an ICP

- Using sales intelligence tools to build a target account list

- Driving collaboration between Sales and Marketing to map out the buying group in each account and determine how to target each individual stakeholder

- Running sales outreach (emails, calls, LinkedIn messages) in tandem with air cover via contact-level ads from Marketing

- Pre-qualifying prospects to ensure that the only opportunities that show up in the Sales pipeline show buying intent and fit your ICP

Pipeline generation has traditionally been a focus point for Marketing, unlike pipeline acceleration, which in most organizations is almost entirely managed by Sales.

The problem is that in most cases, Marketing’s approach to generating pipeline hasn’t been narrow enough.

Marketing goes out to a wide audience (be it the entire market or the entire account), fishes for interest and engagement, captures prospects with a lead form, and then passes those leads to Sales.

We believe that Marketing should play a much more involved, strategic, and nuanced role in generating pipeline especially if you’re going after enterprise.

Marketing’s critical function in generating enterprise sales pipeline

There are a couple of things about selling into enterprise that make deeper Marketing involvement critical.

The first is that you’re not just selling to one person. You’re selling to a whole group of decision-makers (aka a buying committee or buying group).

Forrester’s 2024 State of Business Buying Report found that the typical buying group is made up of 13 people from various departments.

Because of that, and the fact that we’re talking about five to six-figure deals—which means heavy approval processes—it's not unusual for enterprise sales cycles to last a year or more.

It’s a huge job for salespeople to maintain relationships with all thirteen stakeholders, understand their intent, discover and resolve their objections, and remain top of mind during the entire pipeline generation cycle on their own.

The second is that it is hard to stand out. Many SDRs struggle to get a foot in the door for stakeholders at enterprise accounts.

In their study titled Sales Development Representatives and Pipeline Generation, Gartner found that 58% of respondents say that the biggest challenge SDRs face when generating pipeline is competition.

That’s why it’s imperative that marketing doesn’t just stop at generating leads for Sales. You can help reps reach the individuals within target accounts who actually drive decisions.

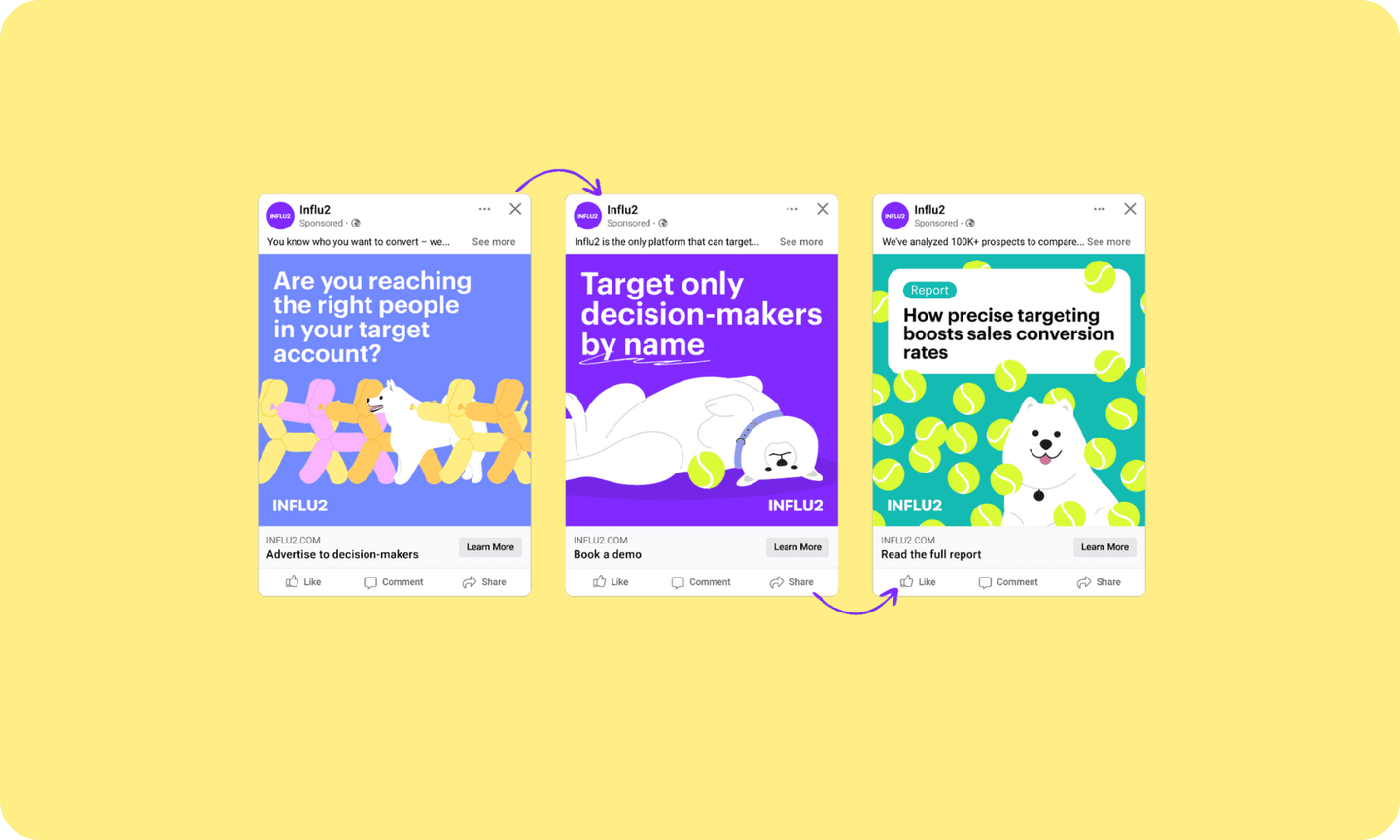

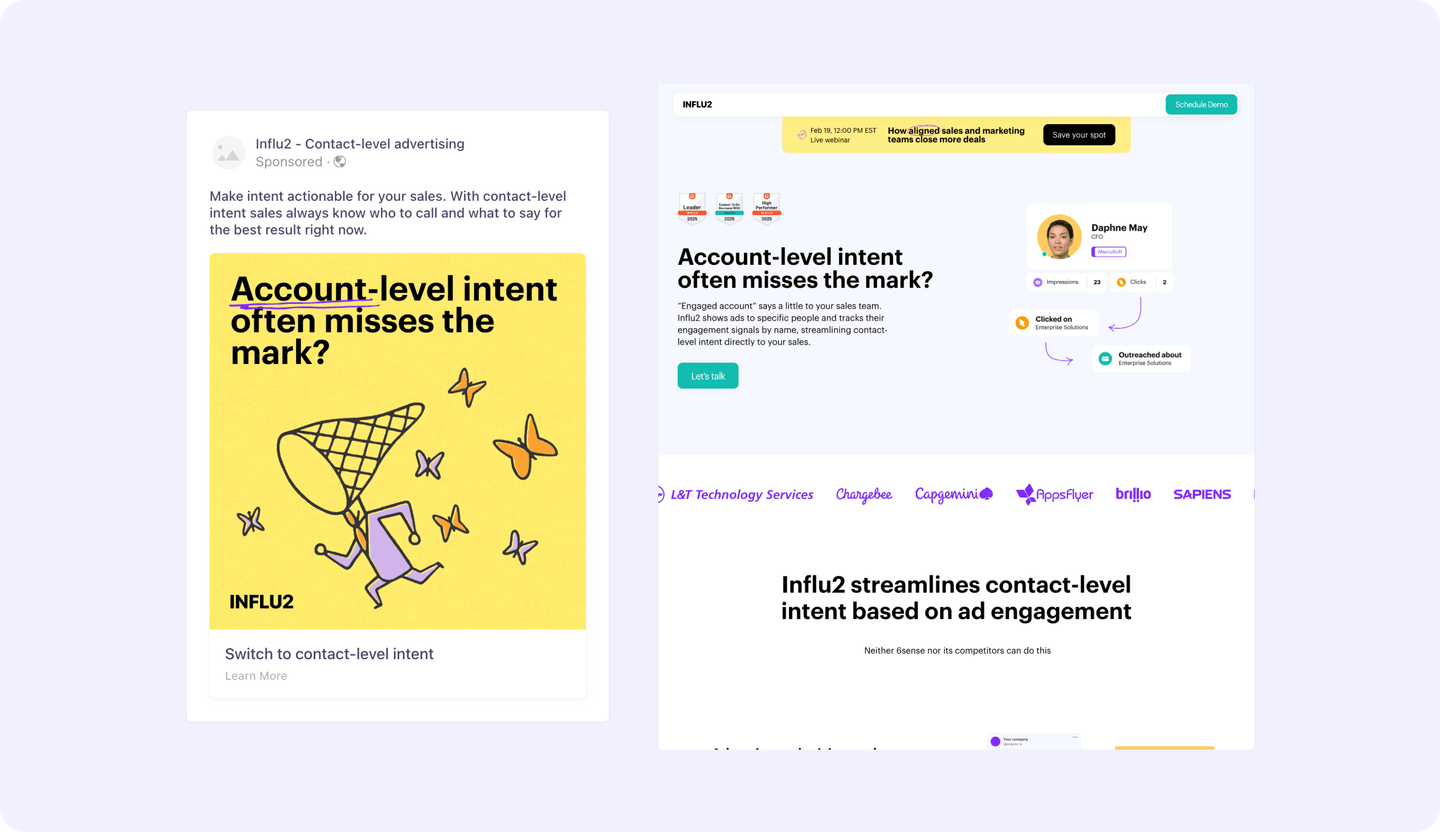

At Influ2, we do this primarily through contact-level advertising, designing ad journeys that adapt based on prospect engagement and that align with the SDR outreach process.

That starts with getting Sales and Marketing aligned.

Aligning on who you’re targeting is step zero

Winning in enterprise sales requires close alignment between Sales and Marketing not only on the accounts you’re going after, but on the specific buying group members within each target account.

If Marketing is targeting account executives (AE’s) while the SDR is cold-calling Sales VP’s and directors, you’re misaligned.

But if both teams were collaborating on pushing the same messages to the same stakeholders across different channels?

Different story.

This alignment should be championed by company leadership, starting with ICP identification.

Figuring out your ICP is an iterative process, especially in a company’s early years, and it's something that all revenue teams (Sales, Marketing, and Success) should be a part of each time it’s back up on the whiteboard.

These are the people who, after all, are engaging with real customers and prospects. They know with whom your product is connecting and who just isn’t into it.

Of course, any decision to target one segment of the market over another should be backed by hard data.

For example, at Influ2, we discovered that specific sizes and titles correlate with better retention.

That’s important for us because we’re interested in customer lifetime value. We want to close accounts that will bring in the most value over their entire lifetime, which may not always be the opportunities that present the biggest deal size upfront.

So, we built our ICP around that.

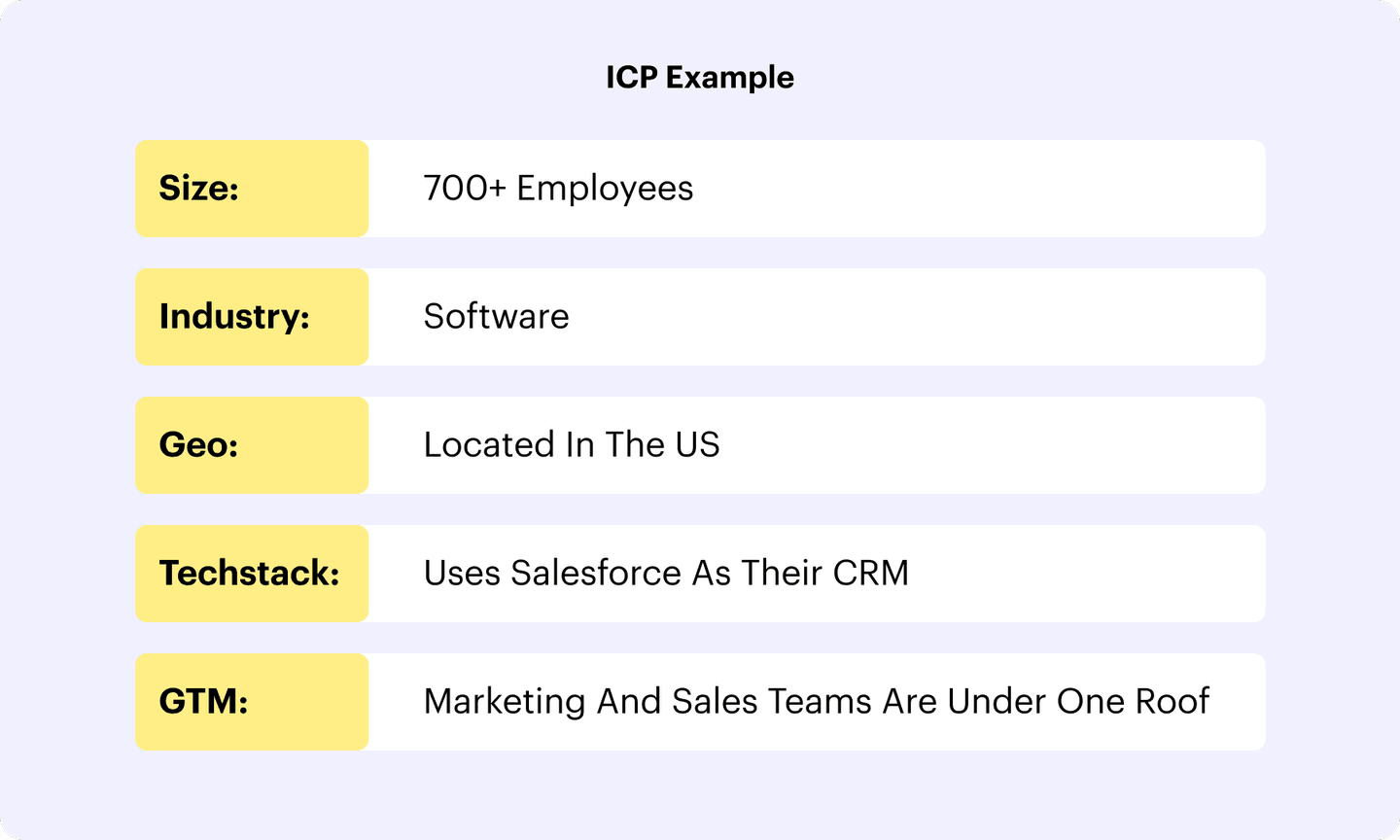

Here's an example of what your ICP might look like:

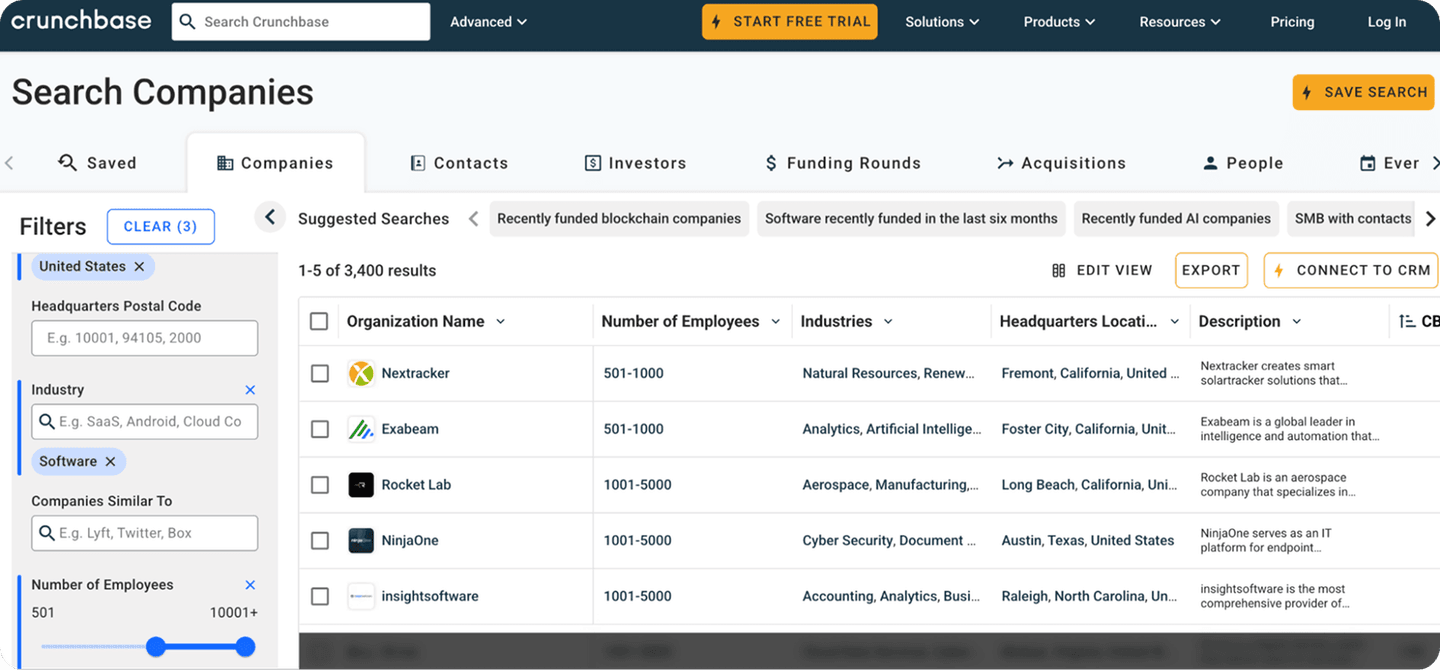

We then search for companies that meet our ICP criteria on LinkedIn Sales Navigator and Crunchbase to build lists of target accounts.

From there, we build the buying group.

Of course, we don’t know which exact people at any given company are part of the buying committee. There’s no “VP of Buying Committee” that we can search on LinkedIn.

What you can do is use historical data on the titles that are typically involved in a deal to build a pretty good approximation. As the deal progresses and Sales identifies additional stakeholders, add them to our audience.

You can use ZoomInfo and Sales Navigator to identify these contacts, sync the audience to Salesforce, and enrich those contacts with the data points your reps need with tools like Hunter, Apollo, and SalesQL.

Then sync those audiences with HubSpot and Influ2 so that Marketing can use contact-level ads to support SDR outreach efforts.

Here’s how:

How to use contact-level ads to support enterprise pipeline generation

Here’s the process we use for pipeline generation. Our strategy is centered on contact-level ads, and we use our product (of course!) to implement it.

Create ad cohorts and set your audience criteria

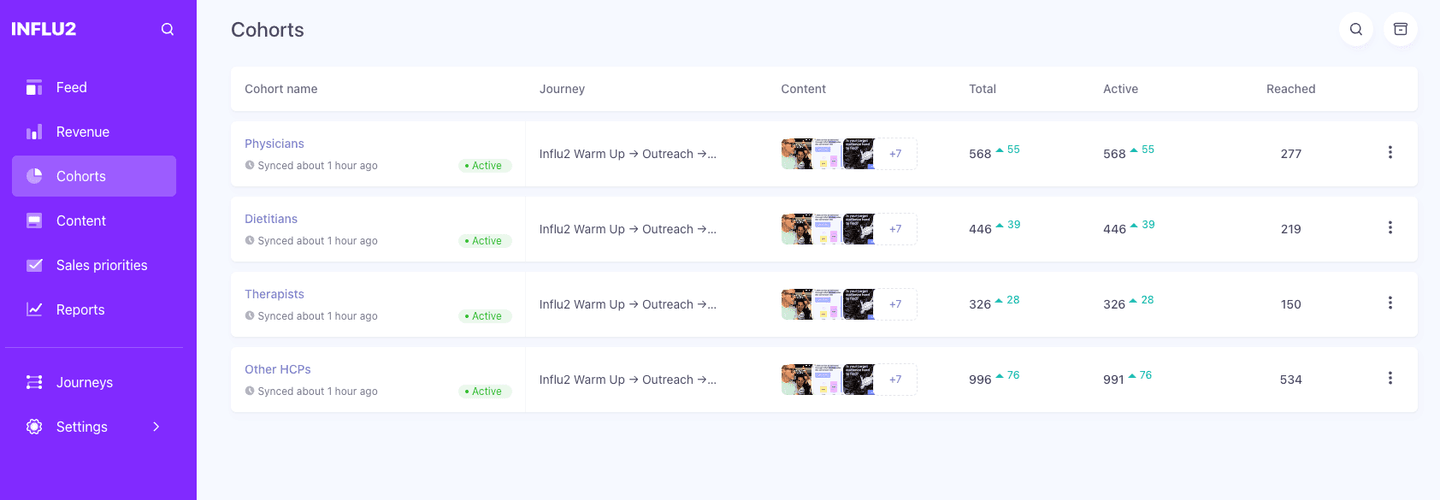

We suggest using cohorts to segment your audience into different ad journeys and ensure individual decision-makers receive relevant messaging.

In Influ2, a cohort is a group of contacts that meet specific criteria.

For instance, at Influ2, we have one ICP, but we break audiences up into different-sized buckets.

A VP of Marketing at a 2,000-person company is going to have very different needs than one with 150 employees, and we want our messaging to reflect that.

You can also create cohorts based on personas to show prospects content that’s most relevant to them.

Sales leaders, for example, see messaging related to core goals like boosting meeting attendance.

This value prop isn’t relevant to the CTO, who may well be part of the buying group. Instead, they’ll see trust content looking to solve common technical objections.

Remember, buyers expect personalization. Giving them ads that actually speak to their needs is a great way to do it. And it’ll come in handy during the next step.

Build ad journeys that align with the outreach sequence

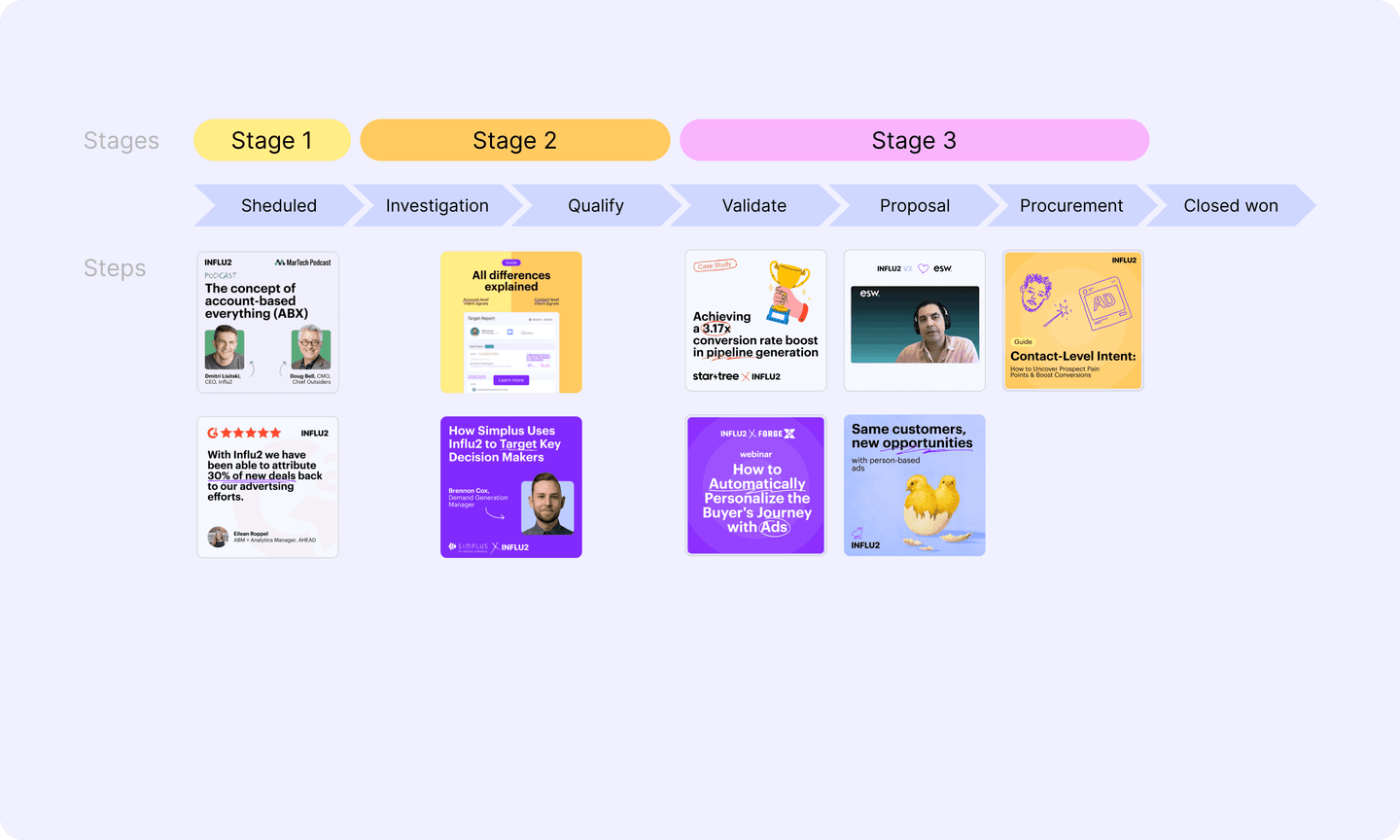

Our ad campaigns are organized to match the steps in our sales process and segmented by personas.

That means that for each persona within our ICP, we have a different ad journey that adapts as the account moves through the outreach and qualification process.

However, you don’t need a different ad for every single stage of outreach.

For example, our sales process has six stages in it, but that would be overkill for the ad journey. We’ve grouped some of them together and built an ad journey with three distinct stages.

Here’s an example of what that looks like. Remember, these can vary for each persona.

All prospects move through the journey stages together, dictated by the account’s status. When an account moves from Scheduled to Investigation, for example, all prospects in that account move from stage 1 to stage 2 of the ad journey.

Within each journey stage, there are multiple steps, each of which has a different ad creative attached to it. Prospects progress through steps based on time and engagement signals.

For instance, they’ll start seeing a new ad (i.e. move to step 2) when:

- They click on an ad, or

- They reach 20 impressions for the same ad, or

- Three weeks have passed

The steps help prevent ad fatigue by making sure prospects don’t keep seeing the same ads for an extended period of time.

The entire ad journey lasts for three months. If a prospect doesn’t convert during this period, they move into a three-month nurture phase, which follows a different ad journey and ensures ongoing engagement and education.

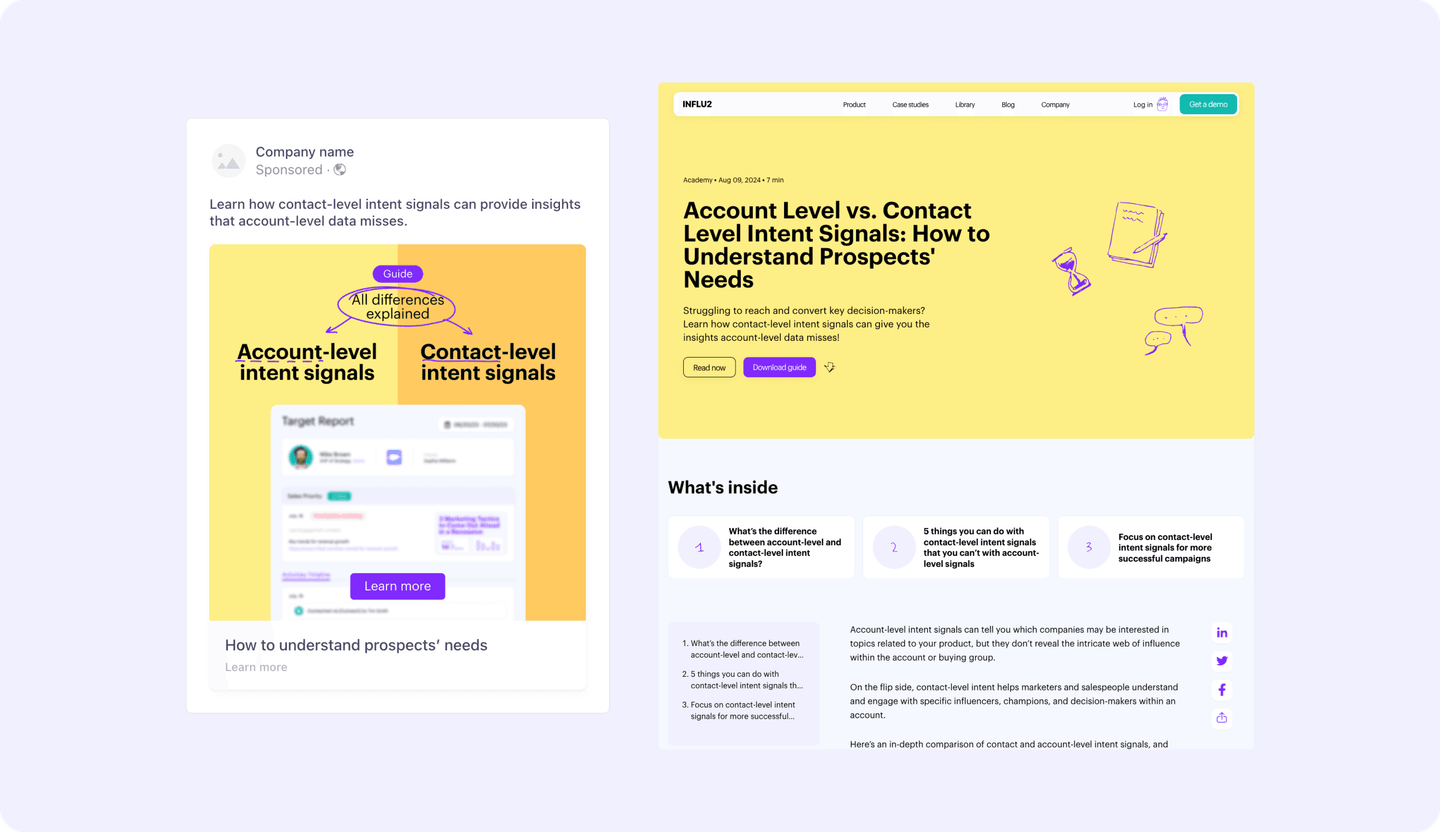

Experiment to discover what content connects

Since you’re engaging with different stakeholders at various stages of the buying journey, you’ll need to develop a range of content types.

We’ve experimented with various formats and approaches over the years. Here’s what we’ve found to be most useful:

- Value propositions: These address specific prospect pain points and highlight the unique benefits of our product in solving them.

- Trust content: Thought leadership materials, webinars, podcasts, articles, and white papers: the idea is to position us as a credible source of information in the industry and lay a foundation for personalized outreach.

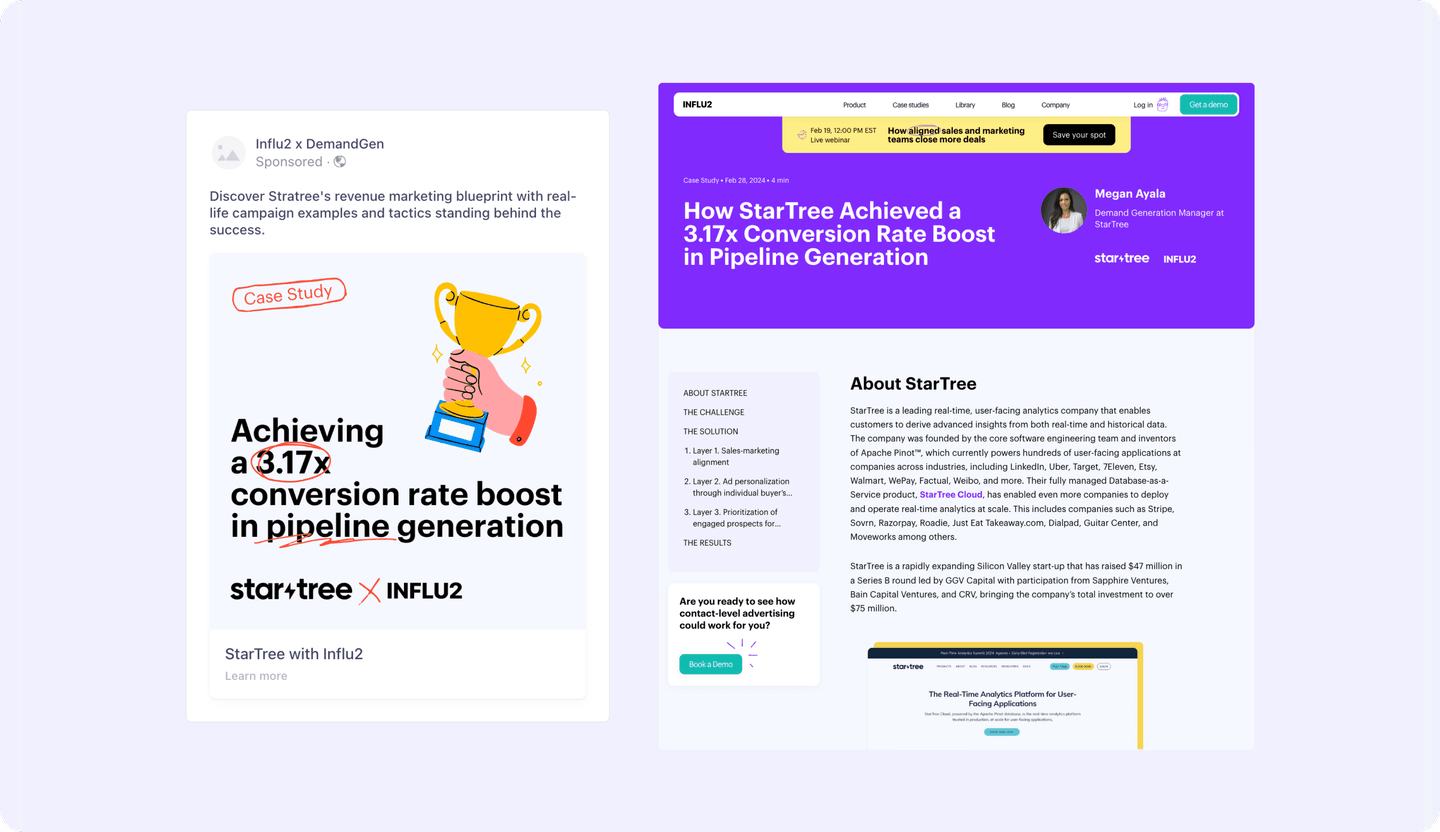

- Case studies: Using real-world success stories to provide tangible examples of how our product works while supporting with social proof.

- Playbooks: Detailed guides that offer step-by-step strategies to help prospects implement solutions effectively.

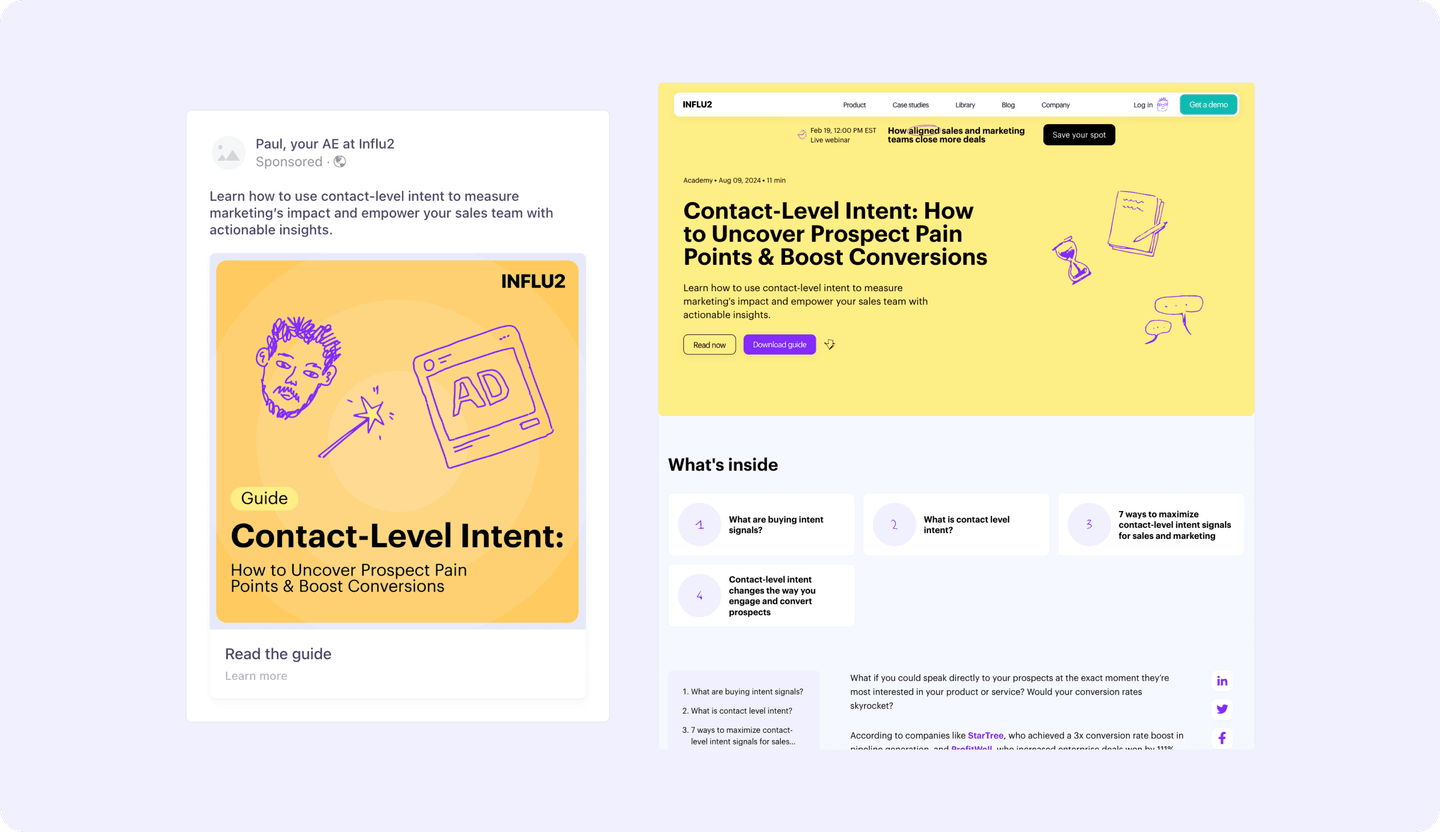

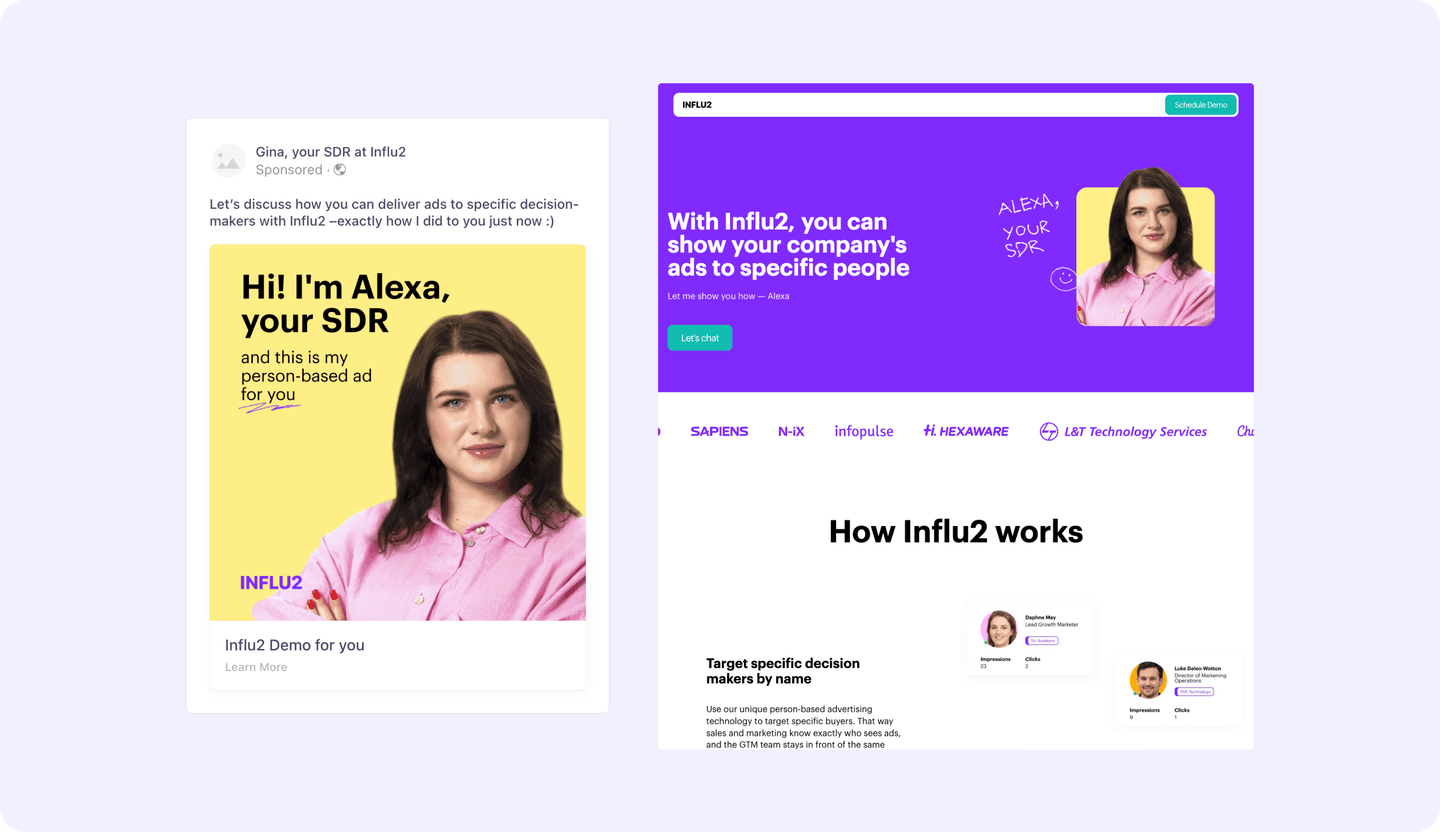

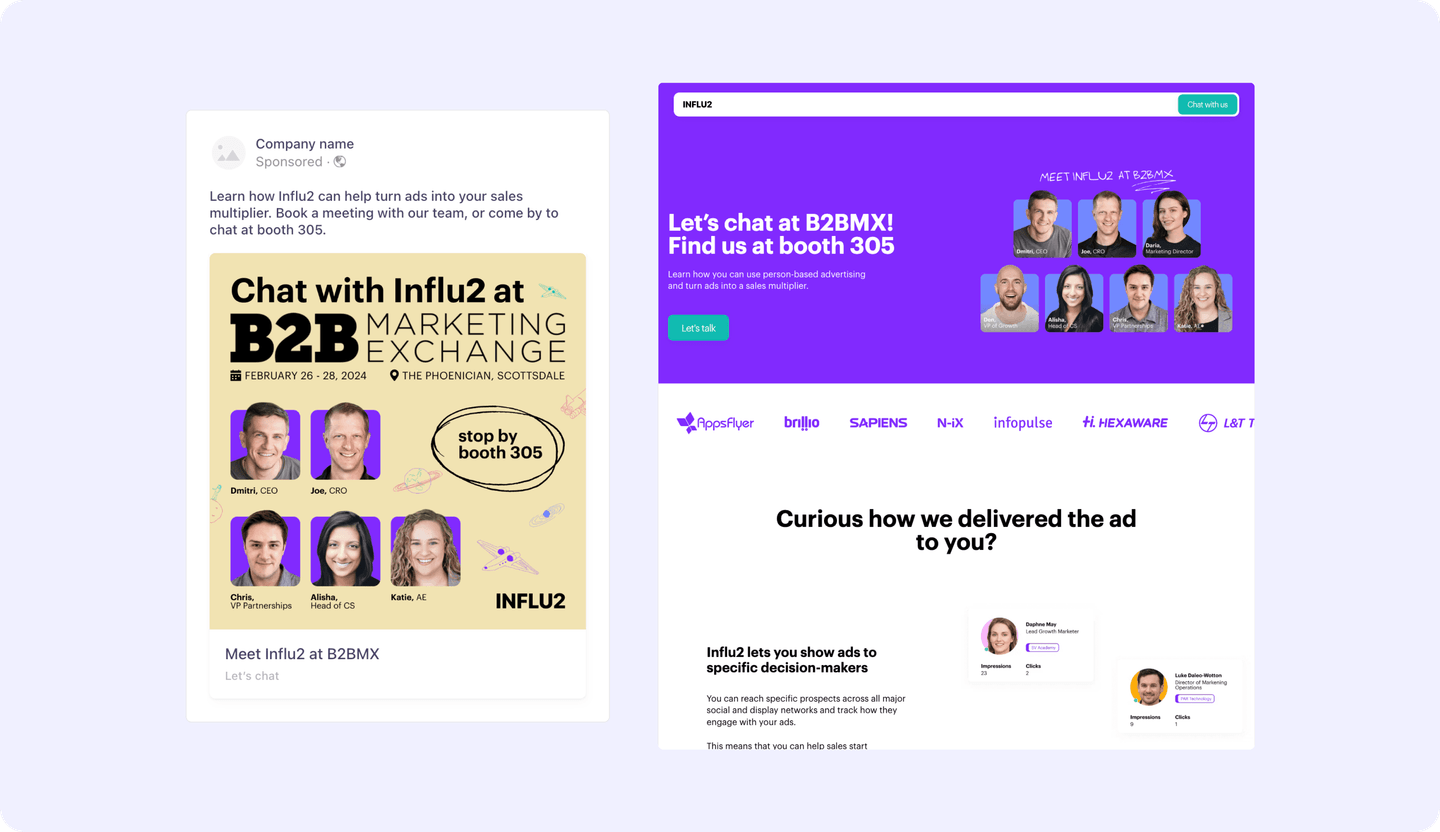

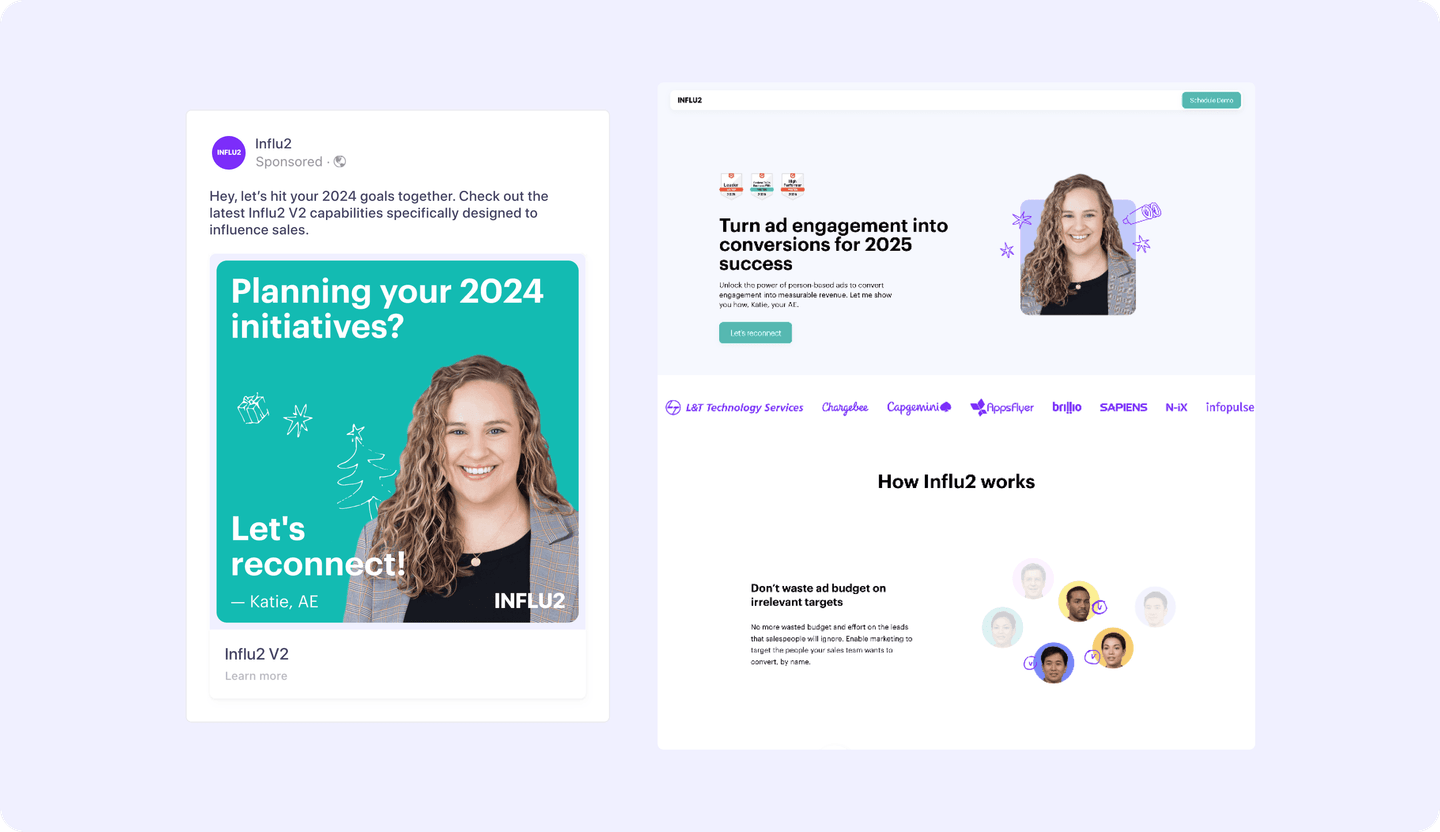

- High-impact content: Ads that feature your SDRs’ faces to add a personalized touch and help reps cut through (more on that soon).

- Ad hoc content: We also use additional ad journeys to promote things like new feature releases and upcoming events.

Of course, these examples are what work for us. Experiment and test to find out what works for your brand and audience.

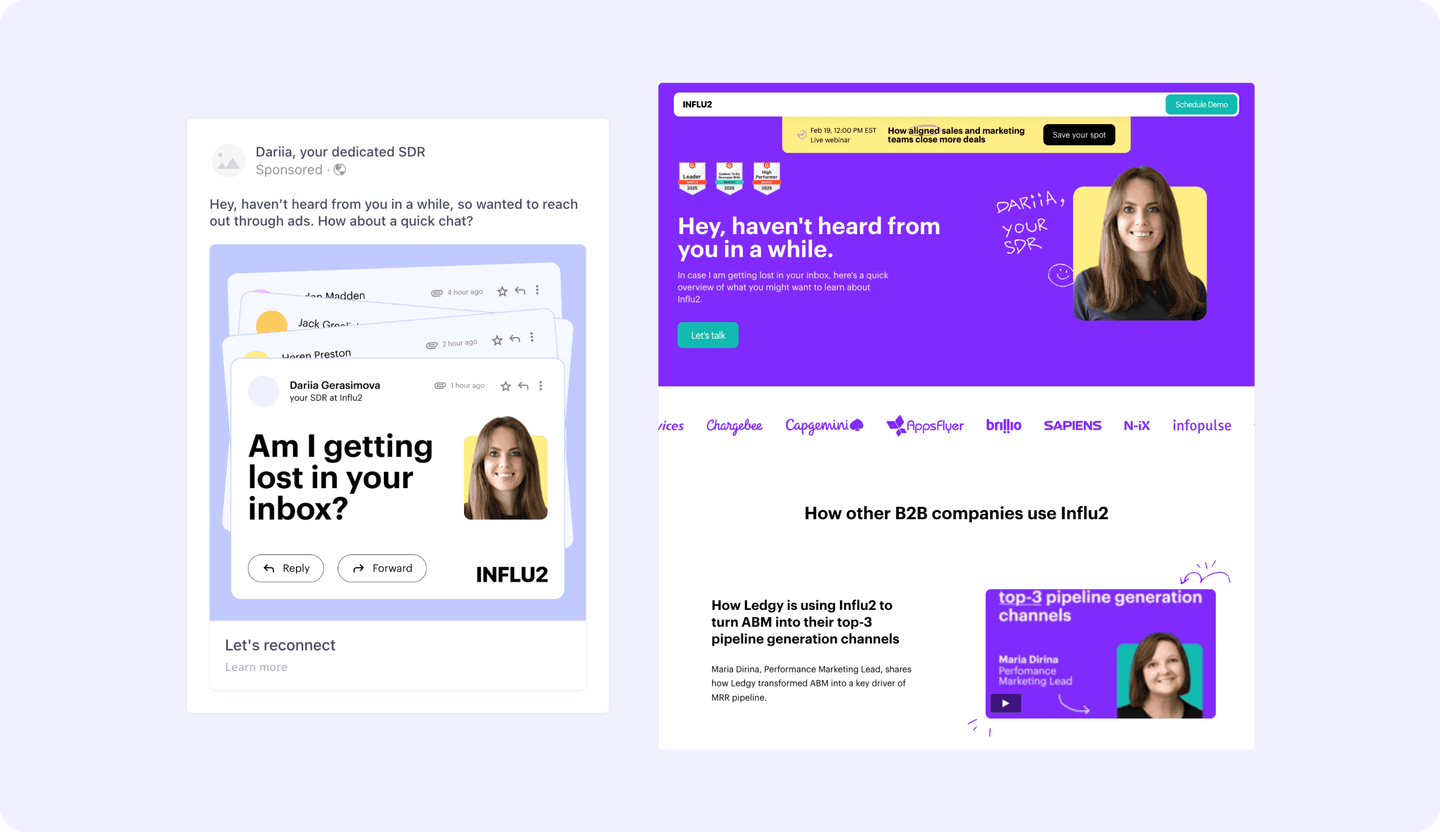

Help SDRs stand out with High-Impact ads

As accounts move through the sales process and buyers’ awareness grows, our ads become increasingly personalized.

One of the most effective content types we use is a group of creatives we call High-Impact ads, where we bring SDR or AE outreach into the ad domain and literally “put a face to the name.”

This is particularly effective for us as it really drives home what our product can do: deliver targeted, contact-level ads to specific decision-makers.

These High-Impact ads are shown toward the end of the ad journey, which is around the beginning of month three. We find that engagement with this ad correlates highly with prospects converted to opportunities (pipeline generated).

If we still aren’t getting responses, we run a series of “last-push” ads, like this one:

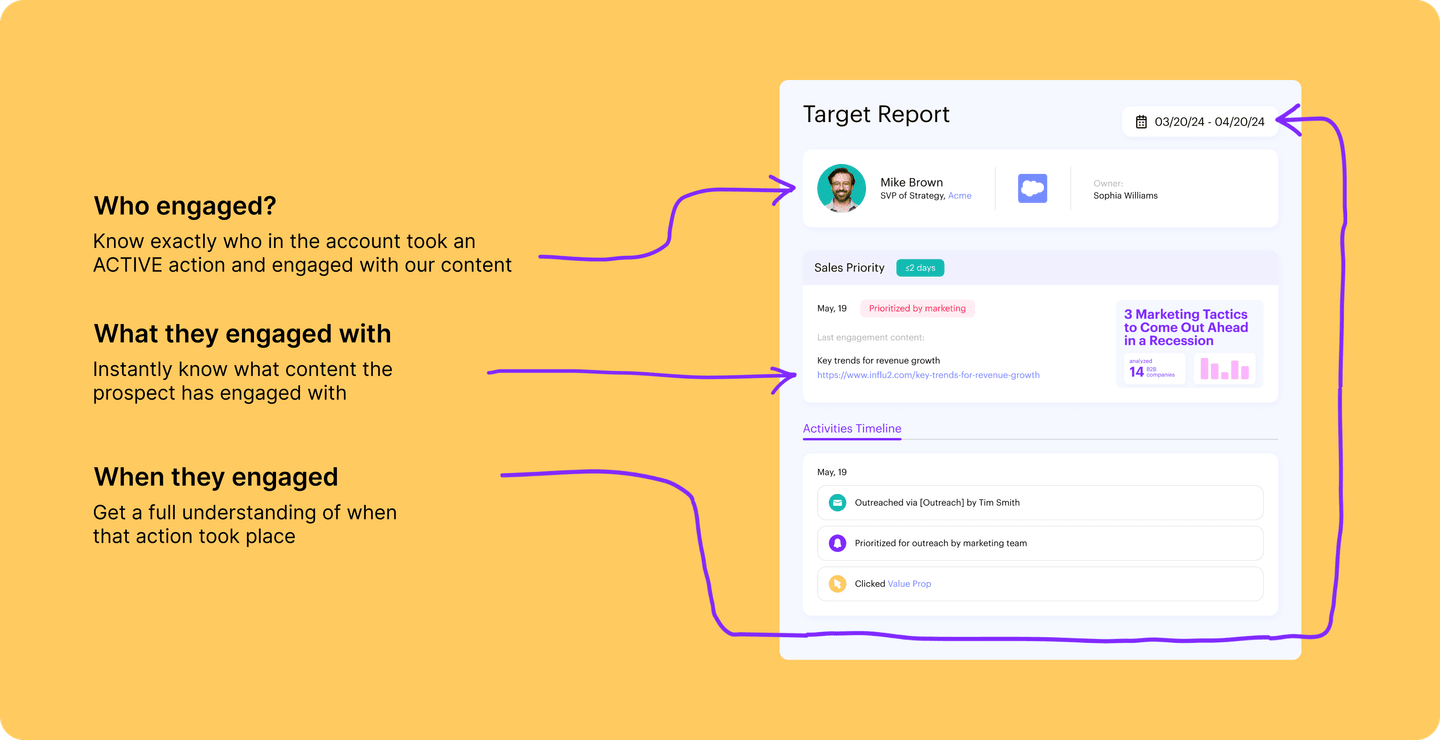

Use contact-level ad engagement data to personalize sales outreach

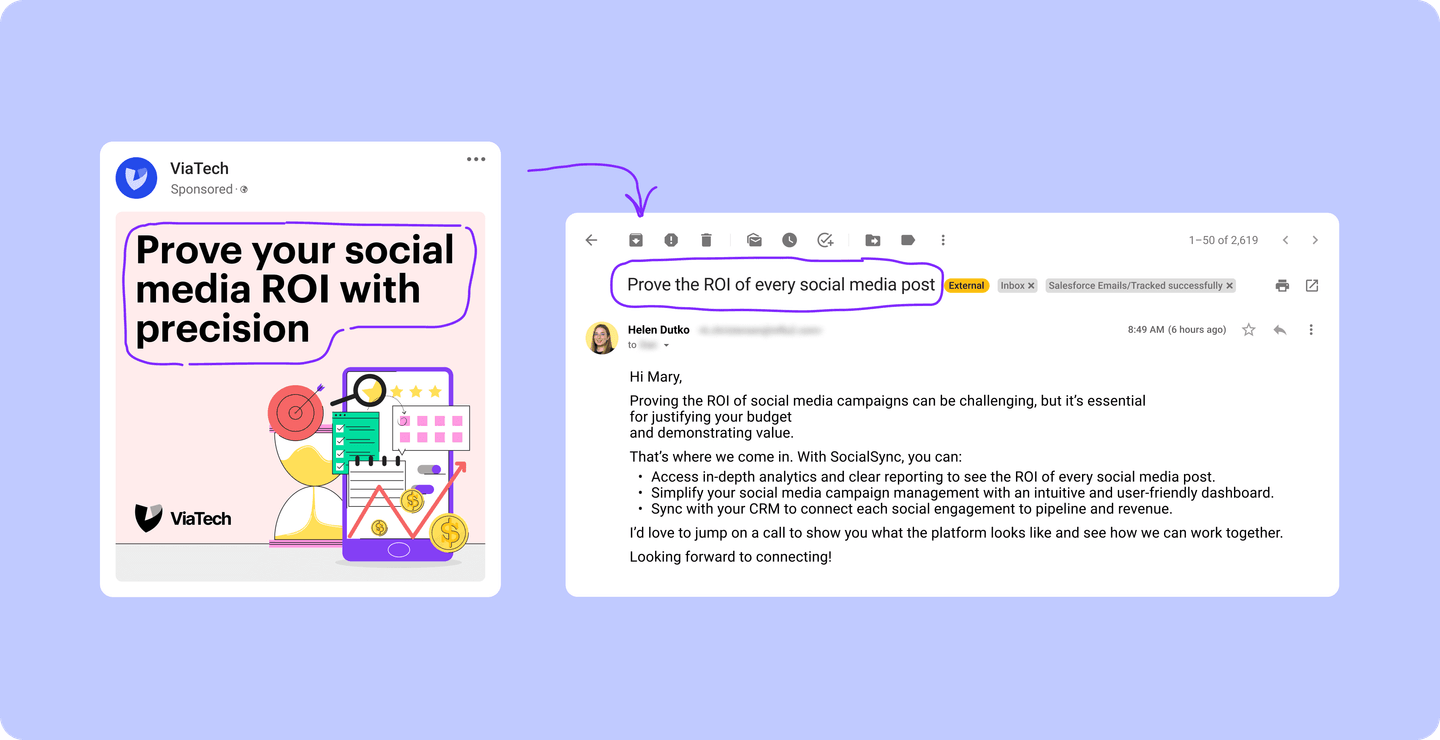

While our ad journeys are aligned with the SDR outreach sequence, it's not a one-way street. SDRs also use ad engagement data to add context to their outreach.

Before reaching out, SDRs can see what ads that prospect has seen and which ones they’ve clicked on, then use this intent signal to tailor their pitch to the pain point that prospect identifies most with.

For example, SDRs can connect the dots between ads and email, keeping messaging consistent and directed to that prospect’s specific intent.

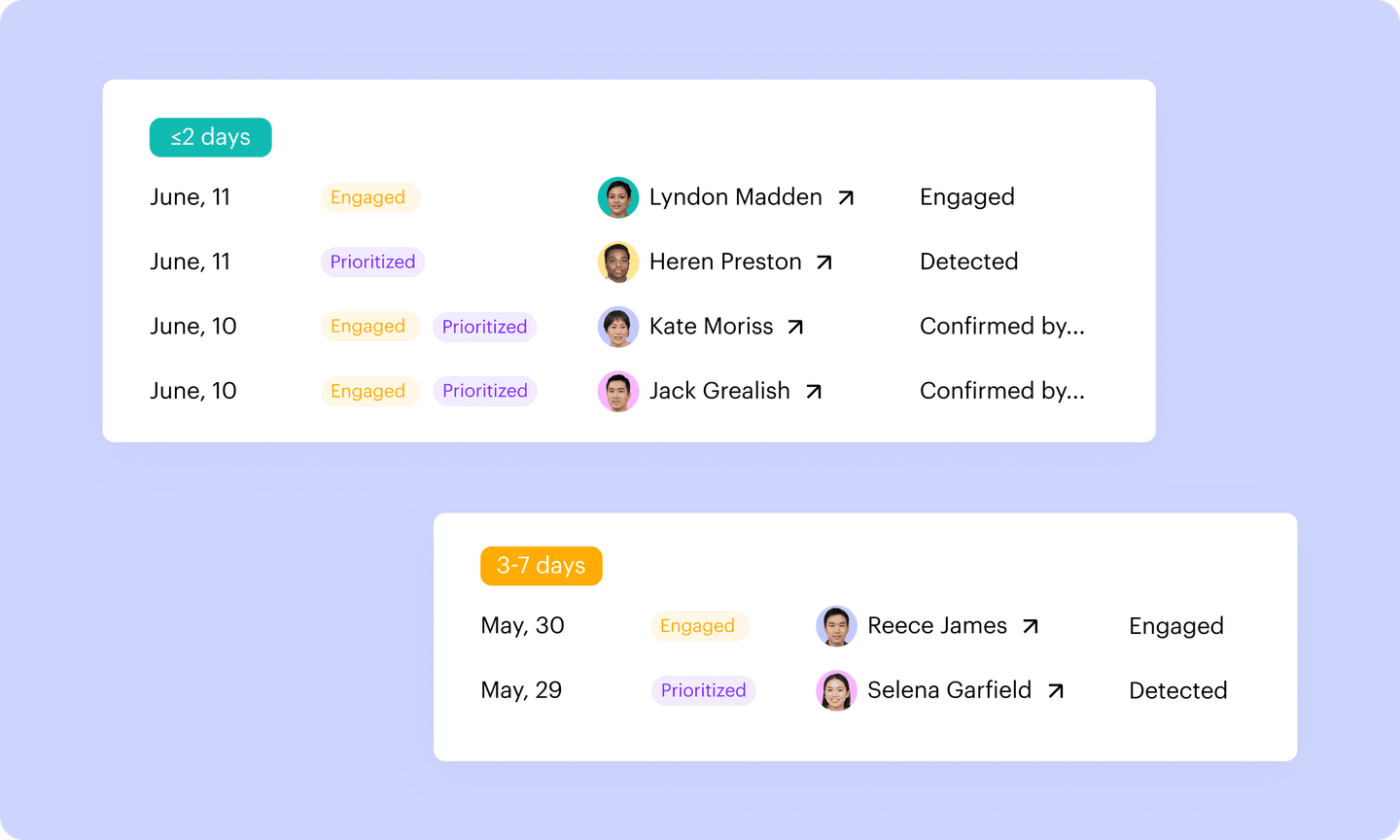

There’s also a timing consideration here.

One study from Nielsen found that after 24 hours, people’s ability to recall an ad they saw dropped by 50%.

This means jumping on engagement signals when they’re fresh is crucial.

Reps use the Sales Priorities dashboard (via our Salesforce integration) to prioritize their outreach cadences based on which prospects have engaged with ad content most recently.

Focus on the metrics that matter

The most effective revenue teams are those that are aligned on what winning means and are all chasing down the same goal.

For pipeline generation, that success metric is pretty simple: pipeline generated (aka Sales Accepted Leads).

Of course, we also want to know what role our ads played in influencing pipeline generation, not least because running ads costs real money and we need to demonstrate ROI.

That’s where you’ll want to bring in marketing-influenced revenue.

With Influ2’s ability to track each ad interaction by name, you’re able to directly link every impression and click to pipeline generation and revenue.

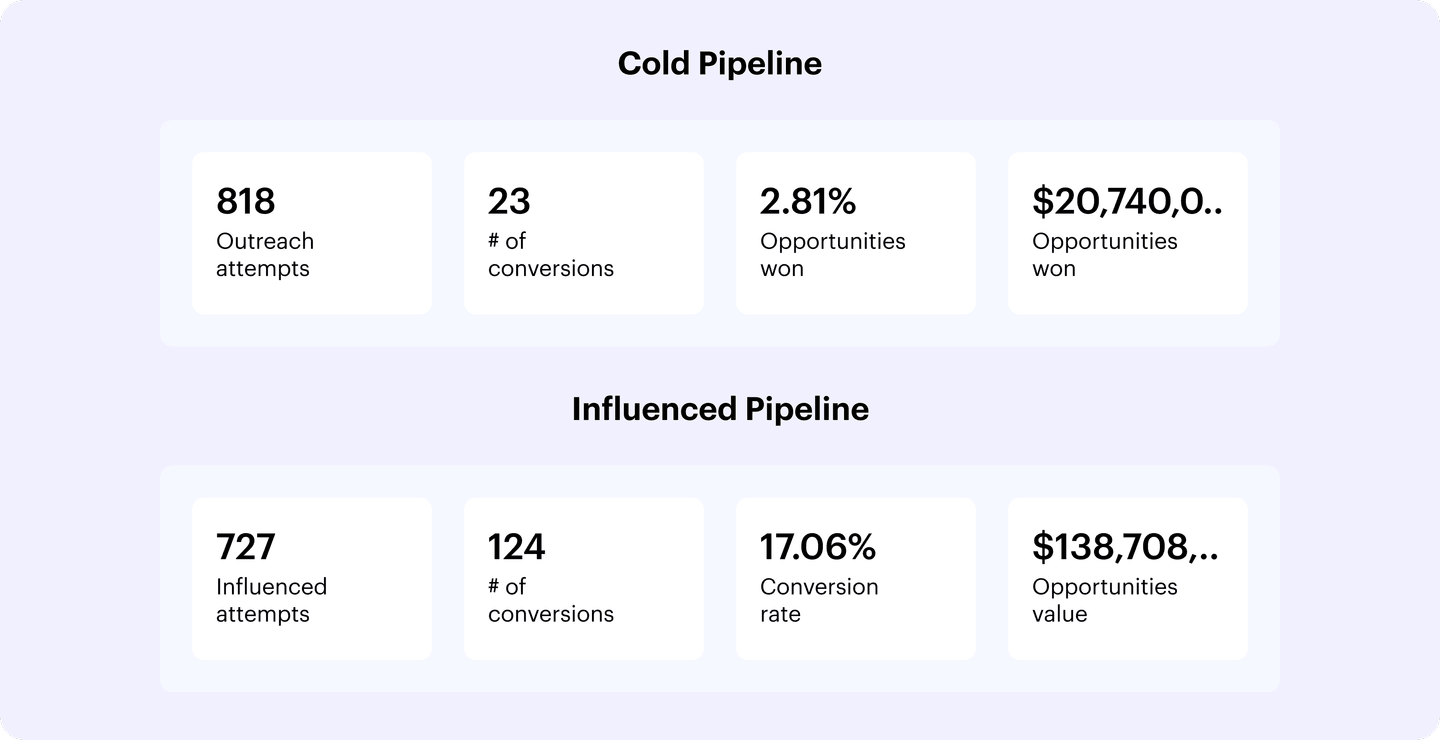

By comparing ad-influenced opportunities against cold pipeline (opportunities that didn’t see ads), you can track the real-life impact of your ad campaigns on revenue.

Learn more about marketing-influenced revenue here: How Marketing-Influenced Revenue Clarifies What Attribution Misses.

Next steps

High-volume brands with single decision-makers and a product-led motion might do well with a wide-net lead-gen approach.

For B2B brands going after enterprise logos with outbound GTM strategies, a targeted, buying group-centric approach driven by contact-level ads is essential for converting deals to pipeline.

You shouldn’t stop there, though. There’s still a lot that Marketing can do to help accelerate and progress sales pipeline.